22.02.2017

Preliminary results for the financial year and fourth quarter 2016:

Telefónica Deutschland once again improves results – focus on operating performance and digital transformation in 2017

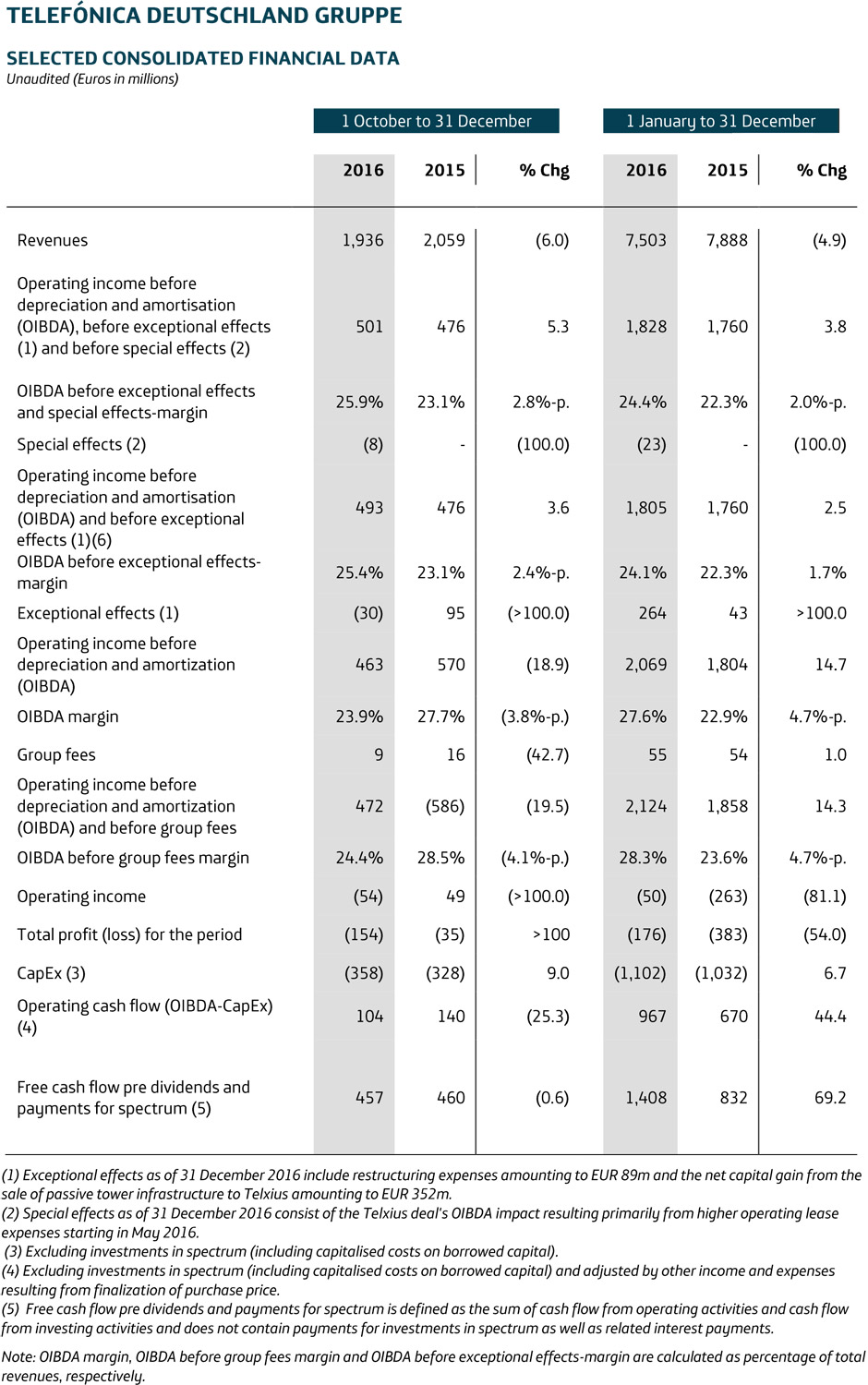

- Adjusted operating income (OIBDA)(1) rose to EUR 1.83 billion in 2016, an increase of 3.8%

- As expected, mobile service revenues (MSR) adjusted for regulatory effects were down slightly by 1.1% year on year and by 1.7% in reported terms

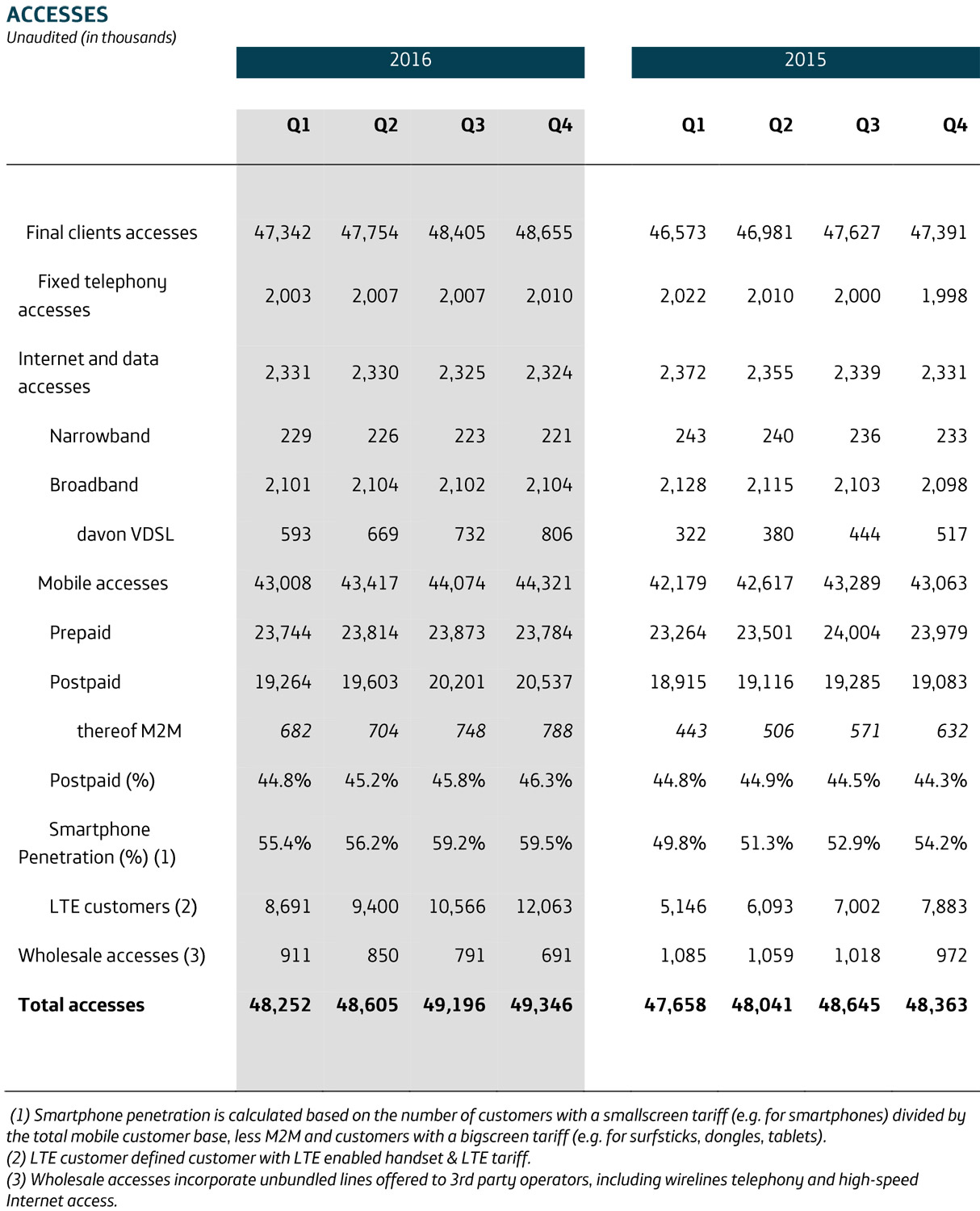

- Market leadership by mobile customers maintained in 2016: Increase of 1.28 million (2) to record number of postpaid customers

- Increase in synergy targets for operating cash flow in 2019 from approximately EUR 800 to 900 million annually demonstrates success of the merger

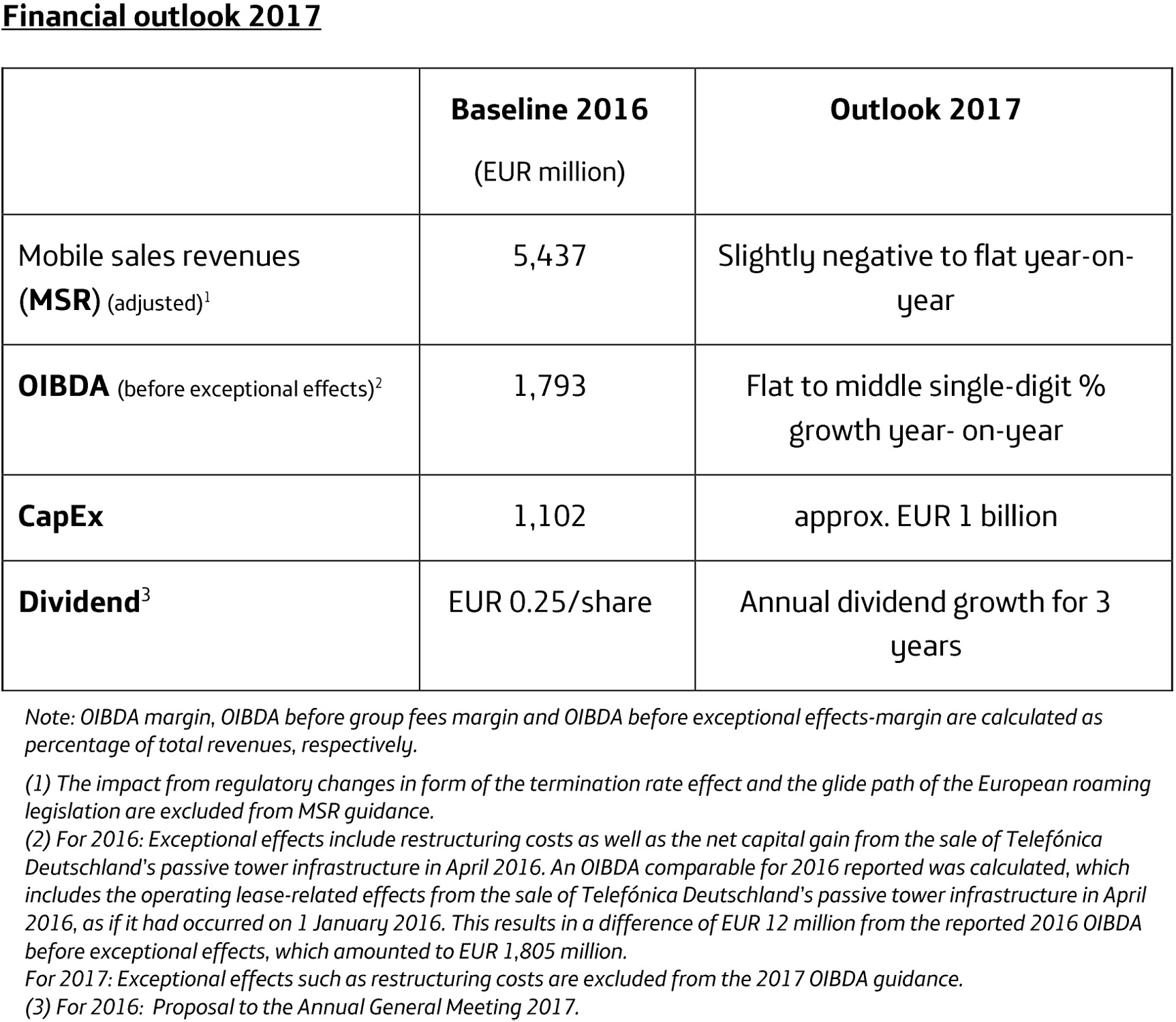

- Outlook for 2017: OIBDA before exceptional effects flat to mid-single-digit % growth. MSR excluding regulatory effects slightly negative to flat

- As announced, dividend for 2016 to increase to EUR 0.25 per share, with further increases planned in the following 2 years

Markus Haas

"We have delivered what we promised," said Markus Haas, who presented the annual results for the first time in his new role as CEO of Telefónica Deutschland. "At the same time, our vision of the OnLife Telco increasingly takes shape. The launch of innovative products such as O2 Free and our progress in establishing our strategic growth areas Advanced Data Analytics and Internet of Things clearly show this. In 2017 we will focus on operating performance and accelerating our digital transformation."

Chief Financial and Strategy Officer Rachel Empey added: "We are progressing better than expected with the realisation of synergies. That’s why we are upgrading our target for annual savings in operating cash flow to approximately EUR 900 million in 2019. That exceeds our original target by EUR 100 million."

Integration completed in key aspects

During the last year, Telefónica Deutschland laid the foundation for its continuing digital transformation into the OnLife Telco. The goal is to give people access to the advancements of digitalisation in a way that is useful to them, anywhere and at any time. The company has largely completed the integration of E-Plus. Telefónica Deutschland finalised the realignment of its brand architecture in 2016 and has pooled all of its customers on a single technical platform. O2 is clearly positioned as the premium brand within the company, while Blau addresses customer groups focusing on value for money through a new tariff portfolio.

Moreover, the company has made significant progress with the planned reduction in the workforce, the consolidation of the shop network and the reduction of office space. In 2016 Telefónica Deutschland pushed ahead with the physical integration of the Telefónica Deutschland and E-Plus networks and picked up the pace of the LTE expansion toward the end of the year. By 31 December 2016, LTE coverage had reached almost 80%. While continuing to expand the high-speed network in 2017, the company will concentrate above all on network consolidation. By the end of the year, this work will be largely completed. The resulting improvements in network performance will directly benefit customers over the course of the year.

At the end of the year, EUR 430 million in synergies had already been realised. That represents more than half of the EUR 800 million in annual operating cash flow synergies originally targeted for 2019.

Digital transformation progressing rapidly

In 2016 the company launched numerous innovative products and services – all geared to meeting customers' needs in their everyday digital lives.

With the O2 Free tariff concept, Telefónica Deutschland ushered in a paradigm shift in mobile communication. For the first time, customers will be online at up to 1 mbit/s, even once they have used up their included high-speed data volume. This means unlimited access to key digital applications. Since the summer, O2 Banking has been revolutionising the mobile banking business. And following the successful rollout of the cooperation with Sky in January, O2 customers can watch top sporting events under exclusive terms wherever they go. The cooperation with TV Spielfilm gives them mobile access to their favourite series and movies as well.

Telefónica Deutschland made good progress over the past year in the development and expansion of its strategic growth areas of Advanced Data Analytics (ADA) and Internet of Things (IoT). It set up an autonomous start-up called Telefónica NEXT in Berlin in order to develop products and services in those areas. First examples of applications include a project in Stuttgart aimed at reducing air pollution and data analysis applications for retail stores. In the IoT field, it is developing a platform to help corporate clients rapidly and cost-effectively develop their individual IoT offerings.

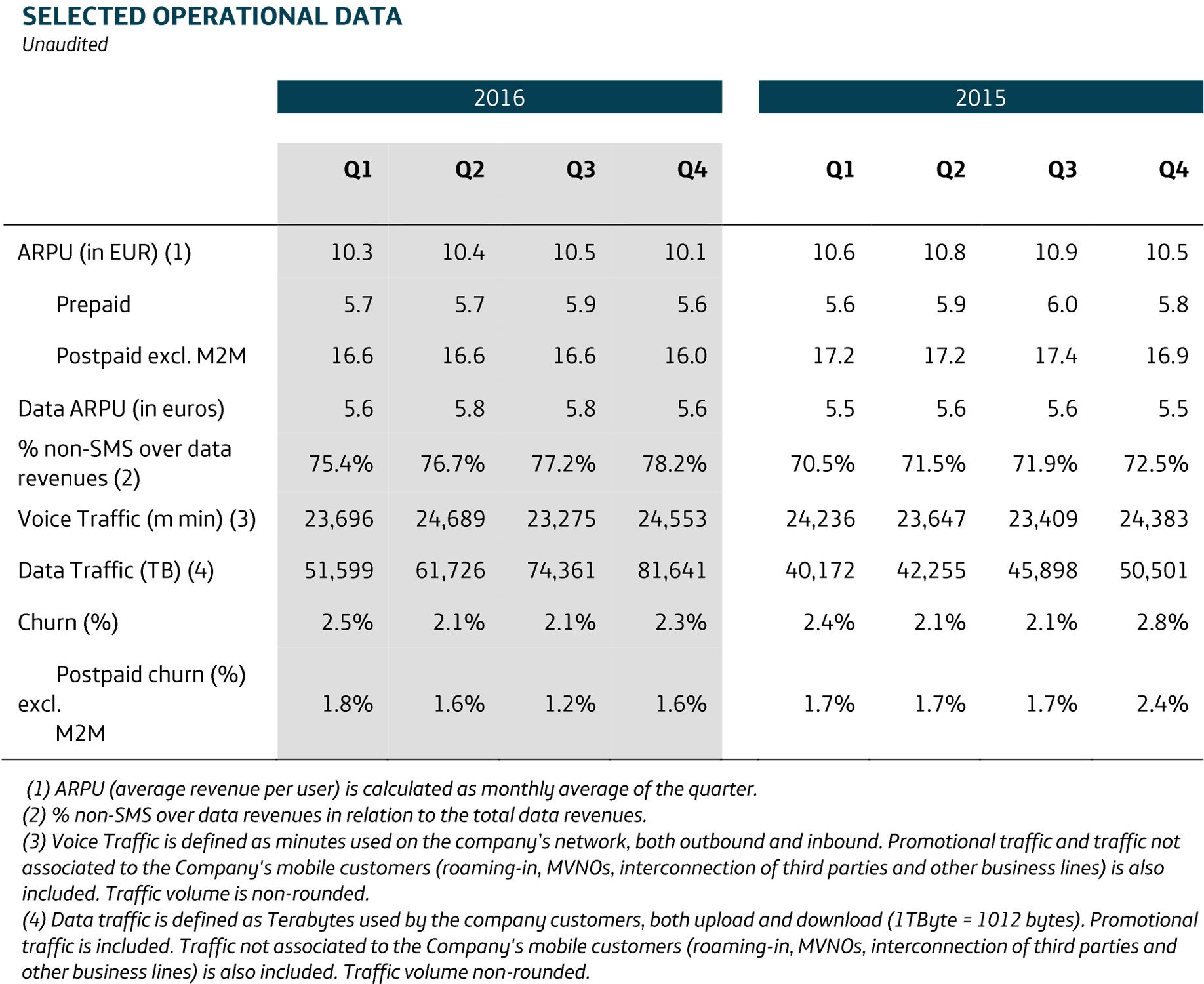

Market leadership retained with the largest wireless customer base

Telefónica Deutschland gained 1.28 million (3) postpaid customers in 2016. The total mobile customer base also increased significantly to a new all-time high of 44.3 million at the end of the year. Telefónica Deutschland thus retained its status as the mobile market leader. At the same time, the churn rate (4) for post-paid customers decreased by 0.1 percentage points year-on-year to 1.6%. For the O2 brand, the churn rate was even lower, at 1.4%.

The number of DSL retail customers rose slightly in 2016 to 2.1 million. Including fixed-line activities, the access base stood at 49.3 million at the end of the financial year (2015: 48.4 million). The growth in customer numbers is indicative of the strong interest and trust in the company's products and services.

Increasing data use and data revenues

Telefónica Deutschland continues to benefit from growing demand for mobile data and especially from customers' strong interest in video and music streaming services.

In 2016, the data traffic carried by the Telefónica Deutschland mobile network amounted to approximately 270,000 terabytes (TB), an increase of 51%. At the end of the year, the average monthly data traffic of O2 postpaid customers was about 1.7 gigabyte (GB) (2015: 1.2 GB). The number of LTE users in the O2 network increased by 53% in 2016 to 12.1 million.

The growth in demand for data is reflected in the revenues. Non-SMS mobile data revenues increased by 13.1% for the full year to EUR 2.30 billion.

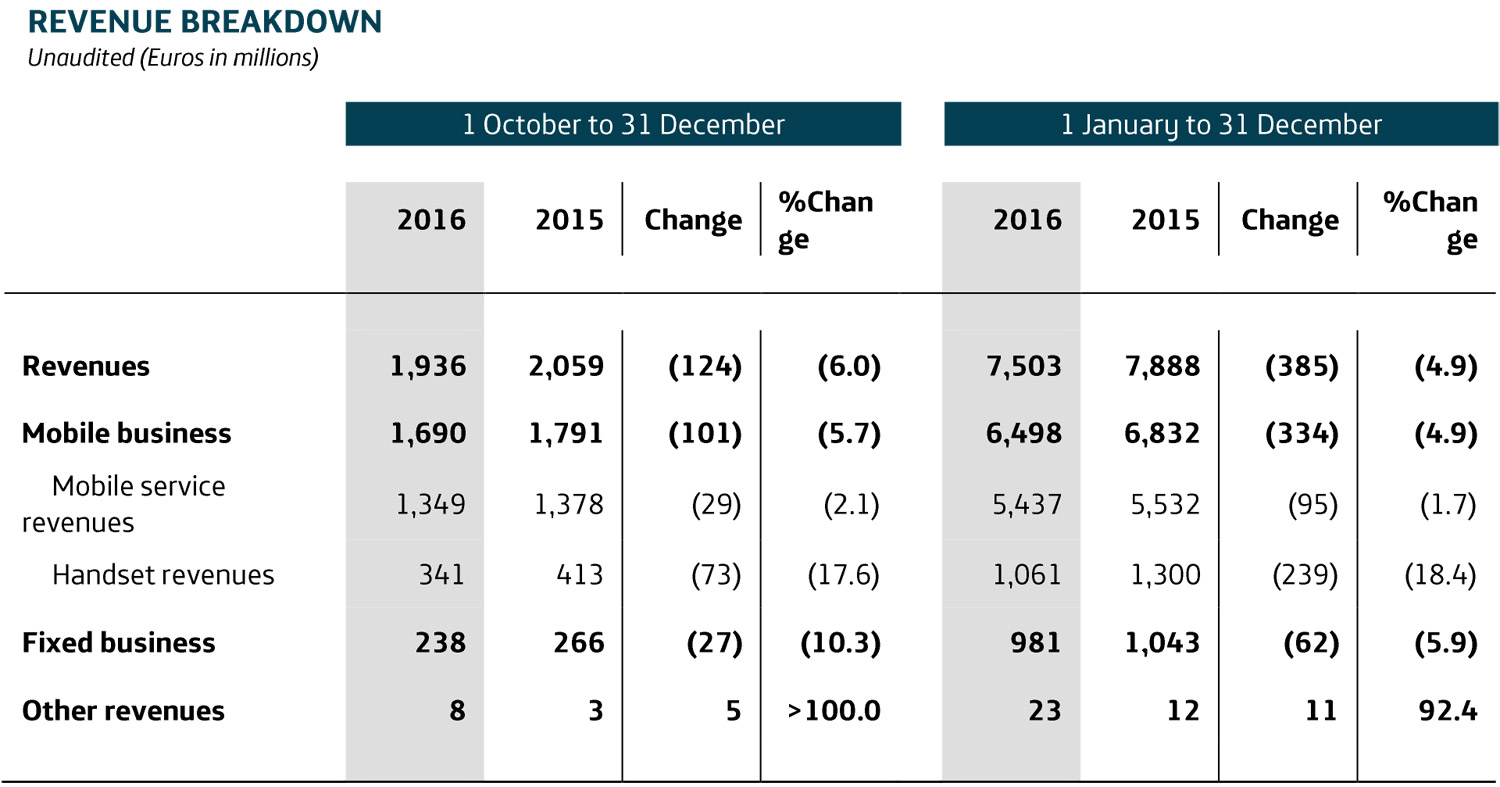

Customers waiting longer before upgrading smartphones

The industry remained highly competitive in 2016. As a result, mobile service revenues fell slightly by 1.7% to EUR 5.44 billion. Along with a growing role of the partner business and a continuing decline in proceeds from voice and SMS, revenues were also impacted by a number of regulatory effects. These included the gradual decrease in roaming charges in the EU and the reduction of mobile termination rates. Adjusted for these factors, mobile service revenues would have decreased by 1.1%, with the development stabilizing in the second half of the year.

Revenues from the sale of smartphones, tablets and other devices amounted to EUR 1.06 billion in 2016 (2015: EUR 1.30 billion). Across Europe, customers are waiting longer before switching to new models and are also increasingly choosing lower-priced smartphones.

Fixed-line sales decreased by 5.9% year-on-year in 2016 to EUR 981.5 million. Total revenues for the company in the year under review declined 4.9% to EUR 7.50 billion.

Further increase in OIBDA underscores strong operational capabilities

Telefónica Deutschland continued to benefit from the positive effects of the merger with E-Plus. On a cash flow basis, additional synergies totalling approximately EUR 150 million were captured in the past financial year. At the same time, Telefónica Deutschland stepped up its investments in LTE expansion in the second half of 2016. Total investments in 2016 increased 6.7% year-on-year to EUR 1.10 billion.

The operating income before depreciation and amortisation (OIBDA) (5) increased by 3.8% to EUR 1.83 billion last year. In the final quarter, the year-on-year increase was even higher, at 5.3%. The adjusted OIBDA margin improved by 2 percentage points for the full year to 24.4%. This does not include the sale in April of approximately 2,350 towers to the infrastructure unit Telxius, which is owned by Telefónica SA. Inclusion of this one-off gain and exceptional effects results in a 14.7% year-on-year increase in OIBDA to EUR 2.07 billion.

As expected, the company recorded a net loss of EUR 176 million for 2016 due to depreciation resulting for the integration of E-Plus and the network consolidation. This has no impact on the company's financial strength.

The free cash flow (6) (FCF) itself totalled EUR 1.41 billion in the year under review. This includes a cash inflow of EUR 587 million from the Telxius transaction.

Telefónica Deutschland closed out the past financial year with net financial debt (7) of EUR 798 million. The leverage ratio is therefore 0.4, clearly within the target range of a maximum of 1.

Strategy: Focus on momentum and transformation

In the past two years, Telefónica Deutschland’s strategy has focused on the three pillars momentum, integration and transformation (MIT). After completing major parts of the integration process, there will now be a shift in emphasis in the corporate strategy to momentum and transformation (M+T). This entails specific priorities.

Telefónica Deutschland strives to provide the best customer experience and sees this goal as a key factor for success in generating future momentum. Important factors in that regard are outstanding connectivity and a commitment to integrated offerings that go far beyond mobile and fixed-line connectivity. This will enable Telefónica Deutschland to offer innovative products and services that address the digital needs of its customers.

At the same time, the management is driving forward the transformation of Telefónica Deutschland. The complete digitalisation and simplification of all processes in the company will boost customer satisfaction and loyalty while also helping to reduce costs. Moreover, Telefónica Deutschland is committed to the safe and reliable processing and analysis of the growing amount of customer data. This will benefit not only the company. It will also open up new business opportunities for Telefónica Deutschland.

Outlook

Telefónica Deutschland achieved significant progress in 2016 in both operational and economic terms, reflected among other things in the positive trends of monetising the increasing demand for mobile data. The company will continue to build on these achievements in 2017. The successful launch of O2 Free will generate additional operational momentum this year. Telefónica Deutschland is cautiously optimistic as it awaits future developments in the market environment. The shift from retail to wholesale is continuing, however, and is counterbalancing the growth of sales for mobile services.

In 2017, the business will be heavily impacted by regulatory decisions. Effective as of 1 December 2016, the Federal Network Agency (BNetzA) reduced the mobile termination rates by 34% to 1.1 cents. This comes in addition to the EU-wide elimination of roaming fees in June of this year.

Excluding these regulatory effects, the company expects the underlying mobile service revenue to be slightly negative to flat year-on-year in 2017. The regulatory effects themselves are likely to result in a year-on-year drag of approximately 3–4% on mobile service revenue.

The company expects a flat to middle single-digit year-on-year percentage growth in OIBDA before exceptional effects (8). This includes the expected impact from the European roaming regulation and the reduction in termination rates. These effects will have a year-on-year impact of 4–5% on OIBDA.

Moreover, Telefónica Deutschland has upgraded its synergy targets for operating cash flow savings in 2019 from about EUR 800 million to approximately EUR 900 million. During the course of the integration process, the company has identified additional synergy potential such as operating cost savings, infrastructure optimisation and simplification initiatives as well as synergies resulting from investment into one LTE network. In 2017, Telefónica Deutschland expects additional savings of about EUR 160 million in operating costs and revenue synergies and approximately EUR 80 million in investment (CapEx) synergies. By the end of the year, the company aims to reach approximately 670 million euros in synergy effects. That represents 75% of the new synergy target.

Investments in 2017 are expected to reach about EUR 1 billion. This is a slight year-on-year decrease, mainly as a result of Telefónica Deutschland benefitting from the roll-out of one LTE network in the aftermath of the merger with E-Plus.

Telefónica Deutschland reiterates its dividend outlook from last July. The company will propose a dividend increase to EUR 0.25 (2015: EUR 0.24) to the Annual General Meeting on 9 May 2017 in Munich. For the two subsequent years, it targets a further increase of the dividend.

| 1) Excluding exceptional and special effects. For the period January to December 2016 exceptional effects include restructuring expenses amounting to EUR 89 million (EUR 73 million in the same period of 2015) and the net capital gain from the sale of passive tower infrastructure to Telxius amounting to EUR 352 million, while in the same period of 2015 a one-off gain from the sale of yourfone GmbH was registered. For the period January to December 2016 special effects consist of the impact of the Telxius deal on OIBDA (EUR -23 million for the twelve months 2016) resulting primarily from higher operating lease expenses starting in May 2016. 2) Excluding the reclassification of 172 thousand customers from prepaid to postpaid as part of the customer migration activities in the third quarter of 2016. 3) Excluding the reclassification of 172 thousand customers from prepaid to postpaid as part of the customer migration activities in the third quarter of 2016. 4) Starting 1 January 2014 M2M SIM-cards are excluded from calculation for postpaid churn and ARPU. 5) Excluding exceptional and special effects. For the period January to December 2016 exceptional effects include restructuring expenses amounting to EUR 89 million (EUR 73 million in the same period of 2015) and the net capital gain from the sale of passive tower infrastructure to Telxius amounting to EUR 352 million, while in the same period of 2015 a one-off gain from the sale of yourfone GmbH was registered. For the period January to December 2016 special effects consist of the impact of the Telxius deal on OIBDA (EUR -23 million for the twelve months 2016) resulting primarily from higher operating lease expenses starting in May 2016. 6) Free cash flow pre dividends and payments for spectrum is defined as the sum of cash flow from operating activities and cash flow from investing activities and does not contain payments for investments in spectrum amounting to EUR 978 million. 7) Net financial debt includes current and non-current interest-bearing financial assets and interest-bearing liabilities as well as cash and cash equivalents and excludes payables for the spectrum auction. 8) Exceptional effects such as restructuring costs are excluded from the 2017 OIBDA guidance. A comparable for 2016 reported was calculated, which includes the operating lease-related effects from the sale of Telefónica Deutschland’s passive tower infrastructure in April 2016, as if it had occurred on 1 January 2016. |