26.02.2014

Full year 2013 financial results:Telefónica Deutschland continues to focus on data monetisation

- Consistent execution of corporate strategy in a competitive market

- Growth in data revenues of 21.7%

- Strong Free Cash Flow generation

"We have been able to demonstrate our ability to increase Free Cash Flow in a particularly demanding environment while strengthening our financial profile", said Rachel Empey (CFO) and Markus Haas (CSO) added, "We are facing 2014 with renewed optimism for the future as we see significant value creation opportunities to be materialised with the envisaged transaction with E-Plus."

Telefónica Deutschland concludes its financial year 2013 with a consistent implementation of its strategy in order to further strengthen its market position: Firstly, capitalize on the multi-brand portfolio and superior customer satisfaction, driving additional efficiencies for the business. Secondly, monetize the data opportunity in all segments through innovative products, digital services and LTE network. Thirdly, maintain a competitive 3G network while delivering LTE technology to urban areas.

Strong data growth and increasing smartphone usage

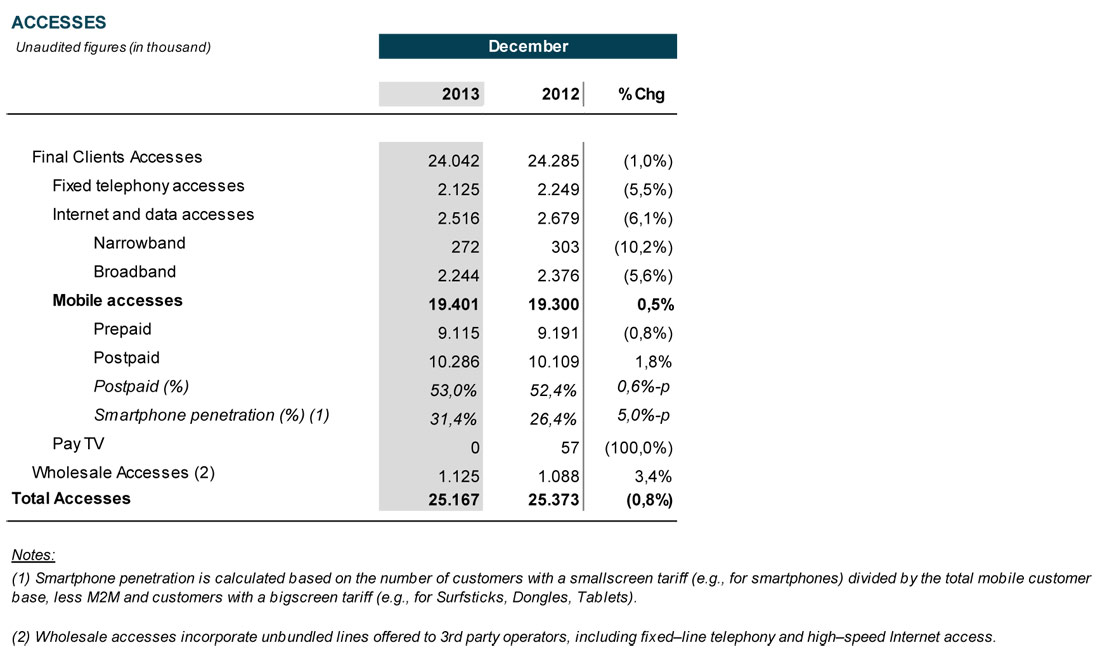

At the end of December 2013, Telefónica Deutschland had 25.2 million customer accesses. The mobile access base grew slightly to reach 19.4 million. The total postpaid base reached 10.3 million customers and the prepaid customer base 9.1 million at the end of December 2013.

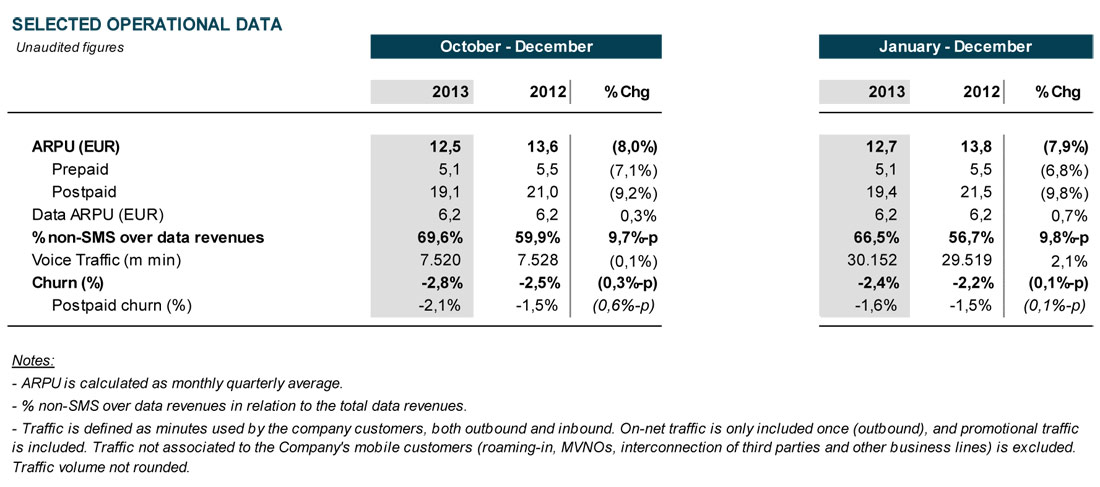

In the last year Telefónica Deutschland continued to monetise data successfully with mobile data revenues including SMS of 1,443 million Euro, representing an increase of 3.7% year-on-year. Non-SMS data revenues registered growth of 21.7% in the full year 2013. SMS contributed only 33.5% to total data revenues.

The growth in mobile data is also reflected in the continued intensive use of smartphones by the customers. As a consequence, smartphone penetration reached 31.4% at the end of December 2013, an improvement of 5.0 percentage points over the previous year. In the specific segment of O2 consumer postpaid, smartphone penetration reached 68.8%. The adoption rate of LTE-enabled handsets from new and existing customers showed a remarkable improvement to make up approximately 80% of total sales in the fourth quarter, which is a leading indicator for further monetisation of mobile data.

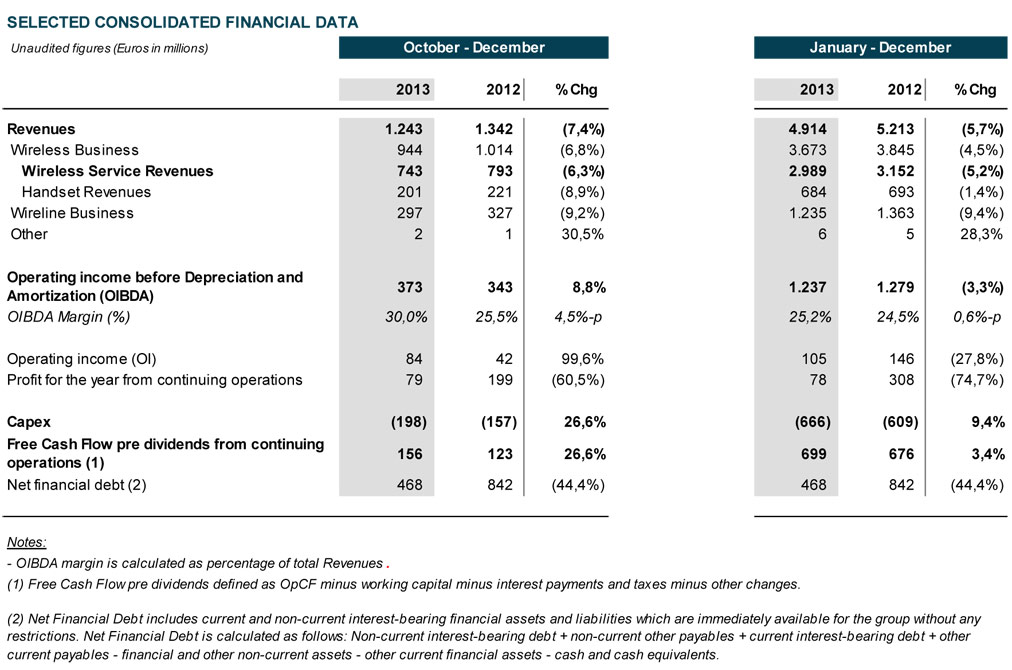

Telefónica Deutschland's revenues reached 4,914 million Euro in 2013, a 5.7% year-on-year decline (-3.5% excluding the impact from mobile termination rate cuts).

Similarly, wireless service revenues showed a continuation of the market trends and amounted to 2,989 million Euro in 2013 (-5.2% year-on-year; -1.5% excluding the impact from mobile termination rate cuts).

Wireline revenues stood at 1,235 million Euro in 2013 (-9.4% year-on-year), mainly resulting from a lower retail DSL base (mitigated by an increasing uptake of VDSL) and a stable evolution of the retail DSL ARPU. This revenue line was also impacted by a further reduction of revenues from the low margin voice transit business.

High level of investments and Free Cash Flow

The Operating Income before Depreciation and Amortisation (OIBDA) declined in the last year and reached 1,237 million Euro (-3.3% year-on-year). OIBDA margin was up 0.6 percentage points year-on-year in 2013 to 25.2% (-0.9 percentage points to 23.6% excluding capital gains from the sale of assets). The year-on-year OIBDA performance was mainly due to an increase in commercial investments focused on mobile customer base retention activities and specific promotions on devices attached to high value tariffs. This added to the negative flow-through effect from revenues to results.

Telefónica Deutschland continued to invest in its technology capability for the future, which is reflected in a rise in CapEx (+9.4% year-on-year) to 666 million Euro. The company focused on supporting future growth with accelerated investments in the development of the LTE network in urban and suburban areas where most O2 customers live. In total, the LTE network coverage exceeded 40% of the total German population in 2013.

Operating Cash Flow (OIBDA-CapEx) reached 571 million Euro in the full-year 2013. Underlying performance of 2013 Operating Cash Flow (excluding capital gains) was -26.2% year-on-year. Despite the downward trend in Operating Cash Flow the Free Cash Flow pre dividends from continuing operations (FCF) developed positively and amounted to 699 million Euro. The strong conversion from Operating Cash Flow to FCF was the result of a positive working capital development of 132 million Euro.

The acquisition process of E-Plus is proceeding. The company reached a further important milestone with the approval of the capital measures for the acquisition at the extraordinary general meeting on 11 February 2014. Nevertheless, the merger still needs to be approved by the European Commission. Telefónica Deutschland expects the closure of the transaction by mid-2014.

Additional data are available in our investor relations section on www.telefonica.de.

| Telefónica Deutschland Holding AG, listed at the Frankfurt Stock Exchange in the Prime Standard, and its wholly-owned, operationally active subsidiary Telefónica Germany GmbH & Co. OHG belong to Telefónica Europe and are part of the Spanish telecommunication group Telefónica S.A. The company offers its German private and business customers post-paid and prepaid mobile telecom products as well as innovative mobile data services based on the GPRS, UMTS and LTE technologies with its product brand O2. In addition, the integrated communications provider also offers DSL fixed network telephony and high-speed internet. Telefónica Europe has more than 102 million mobile and fixed network customers in Spain, Great Britain, Ireland, the Czech Republic, Slovakia and Germany. |