27.07.2016

Preliminary results for January to June 2016:Telefónica Deutschland further expands data business and proposes dividend increase

- New services such as O2 Banking and the partnership with Sky Deutschland drive data monetisation

- Focus on digital transformation after integration successes of the first six months

- Prospect of dividend increase to EUR 0.25 per share for the 2016 financial year; further increases envisaged for 2017 and 2018

- Quarterly result of EUR 252 million due to the extraordinary effect from the sale of wireless towers to Telxius

- Mobile service revenues in a highly competitive market down 1.5 percent in the first half of the year; outlook range narrowed

- CEO Thorsten Dirks: "Our strategy of systematic data monetisation is paying off and will gain further momentum in the course of our digital transformation. Our shareholders should benefit from the positive business prospects through rising dividends."

Telefónica Deutschland is pressing ahead with the expansion of its data-centric business model based on innovative products and announces dividend growth for the next three years. Today the company announced an exclusive partnership with the pay-TV provider Sky Deutschland. Just recently, Telefónica Deutschland introduced several ground-breaking products with the presentation of the O2 TV & Video App and O2 Banking. These will help the company to further monetise the dynamically growing data consumption of its customers. The company expects additional momentum from its digital transformation, which is gaining increasing importance following the completion of key integration projects.

As a consequence, a dividend increase to EUR 0.25 per share will be proposed to next year's Annual General Meeting. The company plans further dividend growth for the 2017 and 2018 financial years. In the second quarter of 2016, Telefónica Deutschland posted a net profit of EUR 252 million (previous year: EUR -68 million). The significant increase was mainly due to the sale of about 2,350 mobile telecommunication masts to Telxius, a subsidiary of Telefónica S.A., in April. In a highly competitive market environment, mobile service revenues were down 1.5 percent in the first half of the year. Against this backdrop, Telefónica Deutschland confirms its mobile service revenue outlook for the full year while narrowing the projected range. Telefónica Deutschland continues to expect that OIBDA excluding exceptional effects(1) will grow by a low to mid single-digit percentage.

"Telefónica Deutschland is a frontrunner when it comes to disruptive mobile offers for the digital lifestyles of our customers," said Thorsten Dirks, CEO of Telefónica Deutschland. "Our strategy of systematic data monetisation is paying off and will gain further momentum in the course of our digital transformation. Our shareholders will benefit from the positive business prospects through rising dividends."

CFO Rachel Empey added: "We will increasingly see the positive impact of our investments in brands, networks and IT in the second half. By the end of this year, we will have already captured more than half of our targeted overall synergy run-rate of EUR 800 million in operating cash flow."

Realignment of brand and product portfolios largely completed

Telefónica Deutschland achieved further key integration milestones in the most recent quarter, focusing increasingly on the digital transformation of the company. Among other things, the realignment of the brand and product portfolios was largely completed during the quarter. O2 is now the sole premium brand. Blau is being established as the company's primary offering in the non-premium segment. BASE was repositioned as a pure online brand a few weeks ago.

The company has made substantial progress with its network integration while continuing to push ahead with the expansion of the LTE network. LTE coverage now extends to 77 percent of the population. The network quality is also appreciated by partners. In recent weeks, several providers have shown interest in a wholesale LTE network access, and some of them have already been connected. Telefónica Deutschland is also moving forward with the network technologies of the future. As an important step towards the gigabit society, the company has set up a 4.5G live trial network in Munich in partnership with Huawei.

Digital transformation leads to tangible successes – partnership with Sky Deutschland

As the digital transformation gathers momentum, the company is creating increasing numbers of disruptive applications and products. Today Telefónica Deutschland announced an exclusive cooperation with the pay-TV provider Sky Deutschland. Offering attractive conditions without long-term contract ties, O2 customers will have mobile access to high-quality movies, series and in particular sports content such as Bundesliga and Champions League football. In June, O2 began offering its customers access to more than 70 TV channels through the O2 TV & Video App, provided in cooperation with TV Spielfilm. With O2 Banking, which was launched just recently, Telefónica Deutschland is revolutionising the mobile banking business. O2 Banking offers customers extra data volume and other benefits instead of low interest rates.

In the new business field Advanced Data Analytics, which deals with the analysis of large volumes of data, Telefónica Deutschland is also performing pioneering work. In Nuremberg, the company’s mobile telephone data help measure with unprecedented accuracy how street traffic affects air quality.

Earnings improve even when adjusting for exceptional effect from tower sale

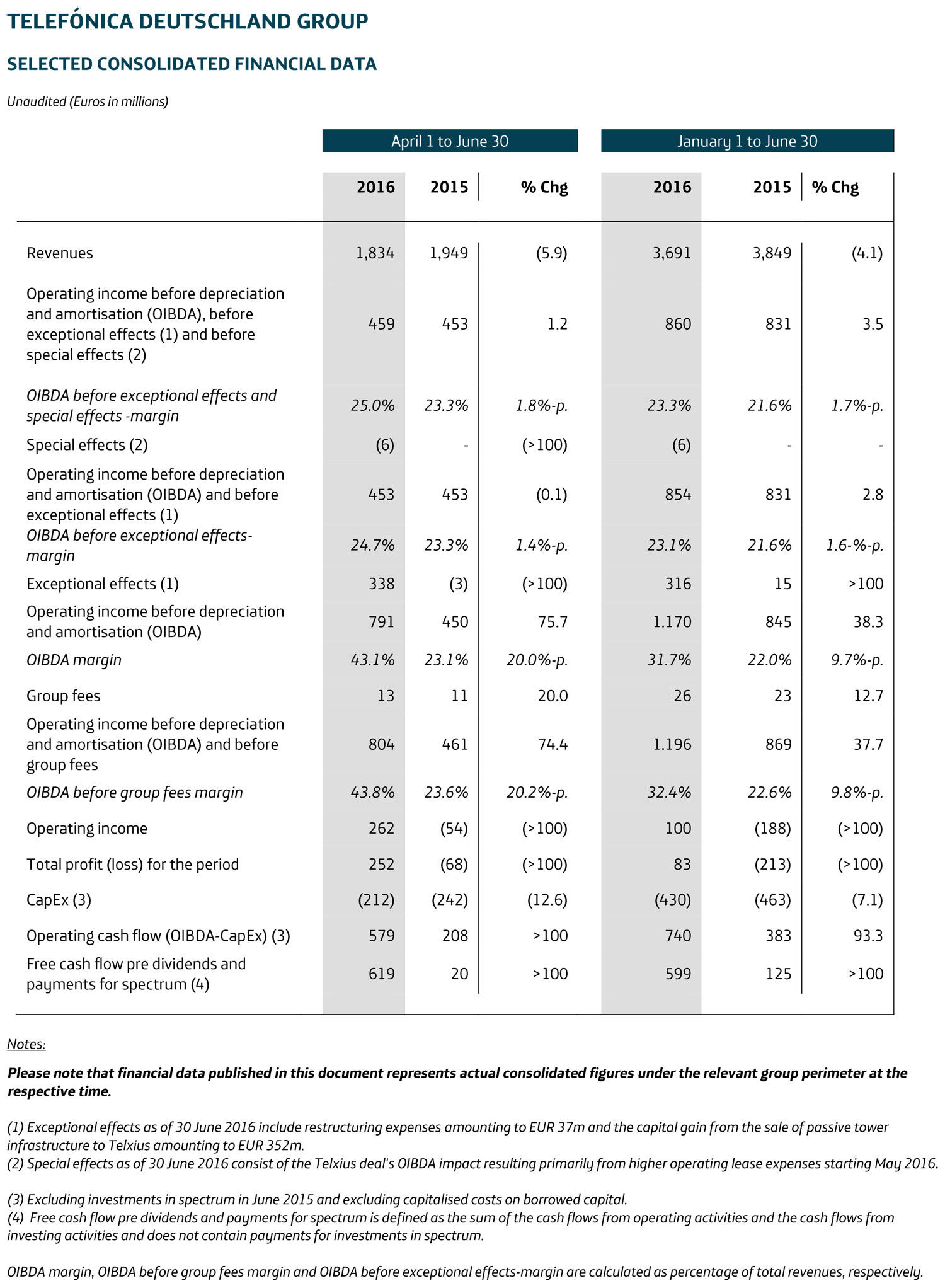

The second-quarter result was characterised by the sale in April of about 2,350 wireless towers to Telxius, a subsidiary of Telefónica S.A. which resulted in a net capital gain of EUR 352 million. Consequently, Telefónica Deutschland posted a quarterly net result of EUR 252 million (previous year: EUR -68 million). Operating income before depreciation and amortisation (OIBDA) was up 76 percent from the second quarter of 2015 to EUR 791 million. Adjusted for exceptional effects and the effects from the sale of the masts, OIBDA improved 1.2 percent to EUR 459 million. In the first six months of 2016, OIBDA grew by 3.5 percent to EUR 860 million, mostly driven by successful synergy capture following the integration of E-Plus.

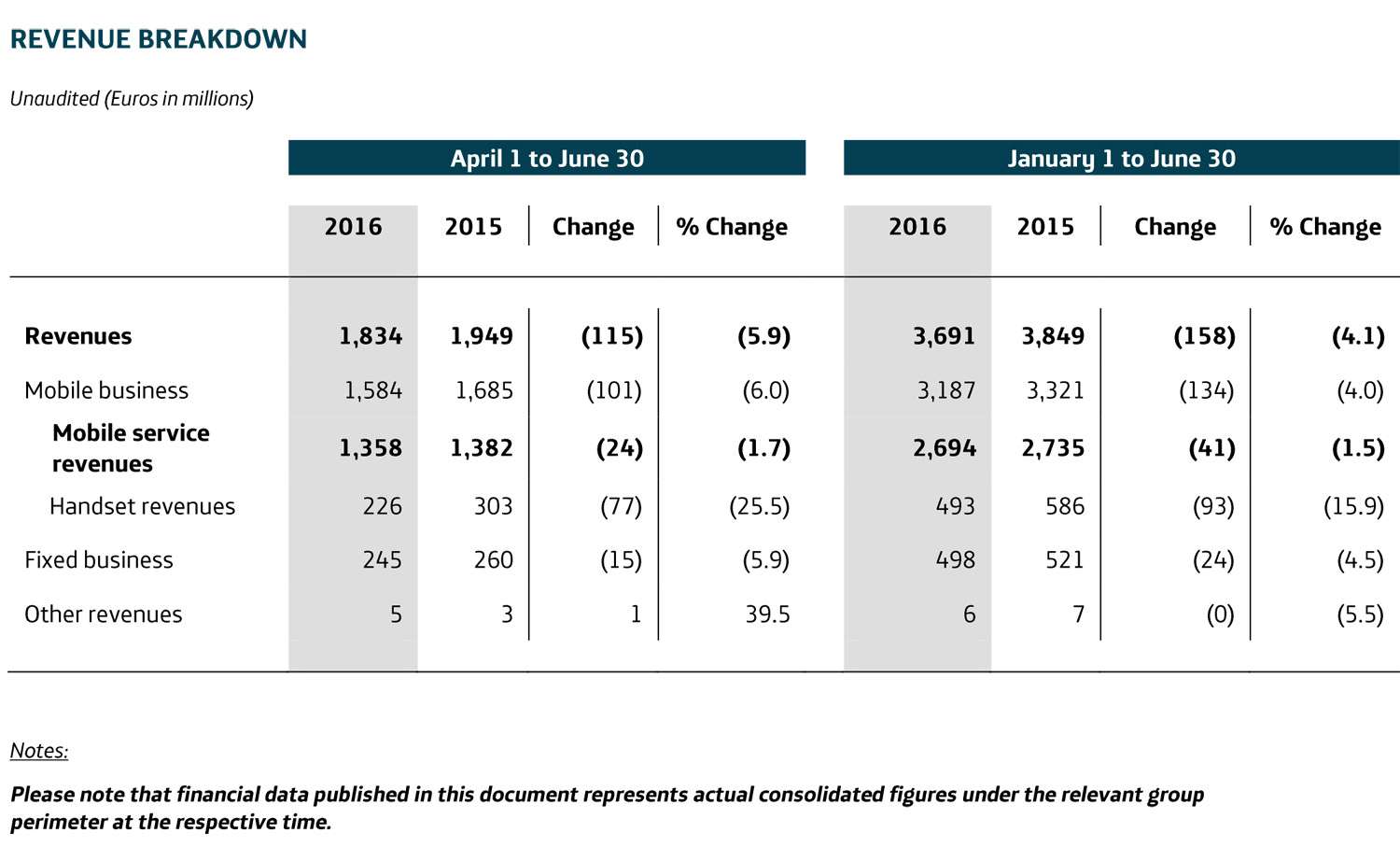

Since the beginning of the year, competition has intensified especially in the non-premium business. In addition, there are headwinds from effects relating to the development of the customer base as well as regulatory effects. As a result, mobile service revenues declined slightly by 1.7 percent to EUR 1.36 billion in the second quarter. For the first half of the year the decrease amounts to 1.5 percent.

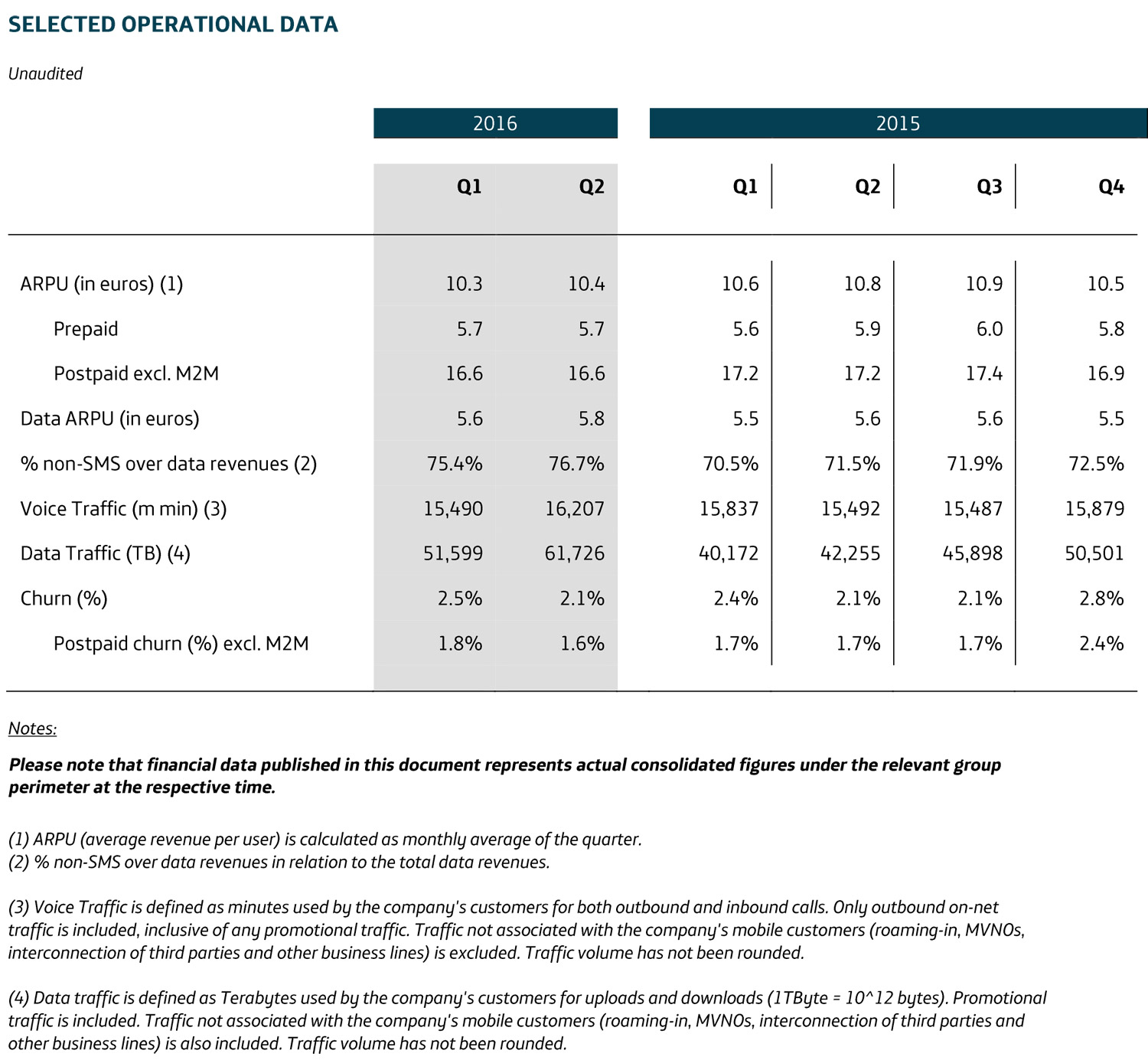

Customer data usage on the rise – video and music as key drivers

At the same time, the company again benefited from growing data consumption among its customers, driven primarily by their use of music and video streaming services. The mobile data consumption of O2 postpaid customers with LTE was up 42 percent year-on-year to 1.4 gigabytes (GB) per month(2). The greater data usage as well as upselling measures within the existing customer base supported the continuing positive development in average revenues per postpaid customer (ARPU). In the coming months, the cooperation agreements recently signed with TV Spielfilm and Sky Deutschland will further boost mobile data consumption.

In the second quarter, the successful growth in the mobile data business was reflected in an accelerated rise by 14 percent in mobile data revenues, excluding SMS messaging, to EUR 574 million.

Demand for smartphones and tablets has recently seen a noticeable slowdown across the industry. As a result, handset sales dropped 26 percent in the quarter just ended to EUR 226 million as compared with the very strong result in the same quarter a year earlier.

With the decline in handset sales and slightly lower mobile service revenues, total revenues from April to June decreased to EUR 1.83 billion (Q2 2015: EUR 1.95 billion).

Continued strong growth in mobile customer accesses

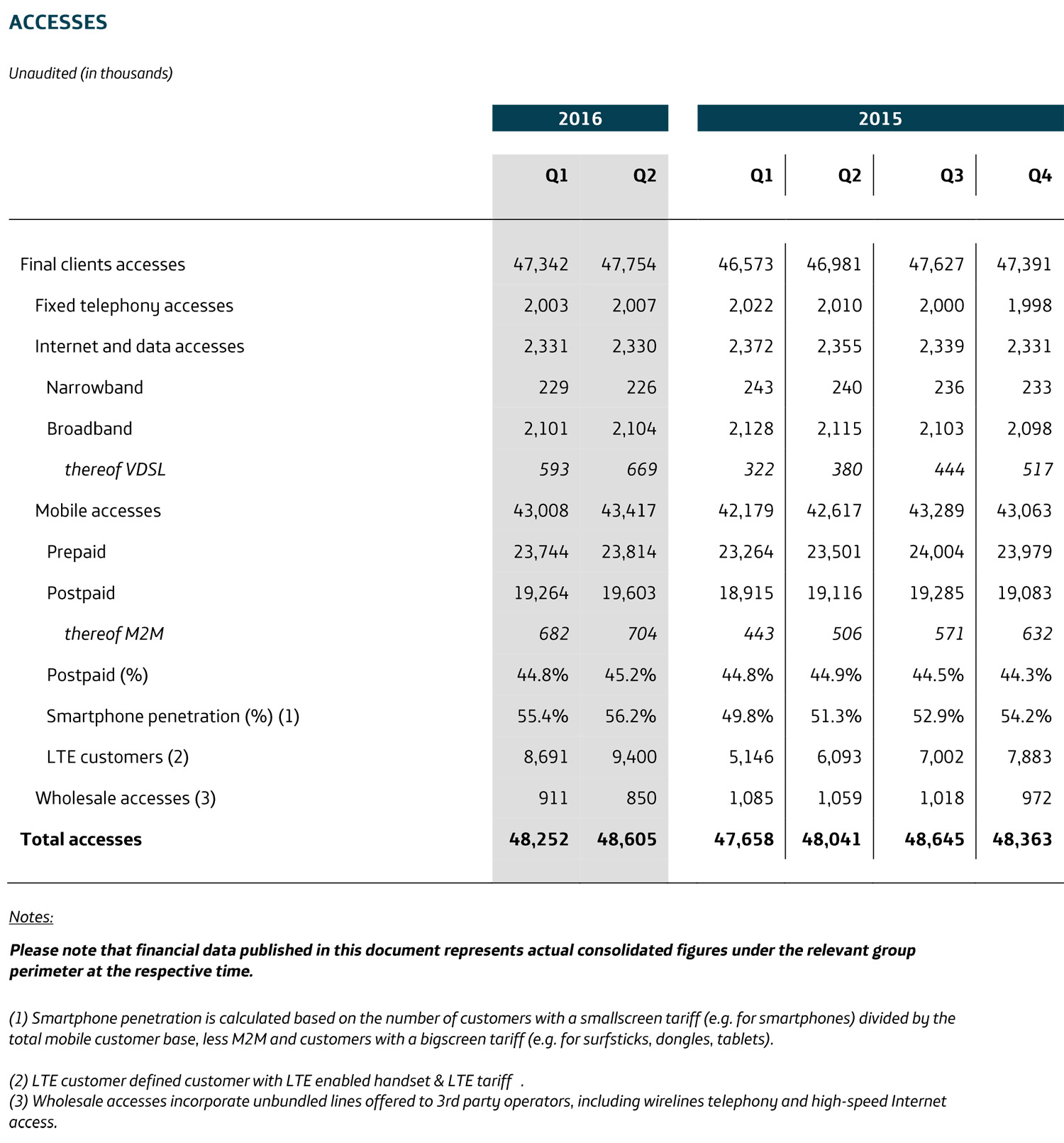

The company achieved a substantial 1.2 percent increase in customer accesses to over 48.6 million at the end of June compared with the same date a year ago. The total number of mobile accesses increased 1.9 percent to 43.4 million, with 19.6 million of those being postpaid accesses.

Telefónica Deutschland continues to focus on cross-selling and up-selling among existing customers. As a result, total churn decreased by 0.4 percentage points to 2.1 percent during the second quarter. At the same time, the company registered a strong 339.000 postpaid net additions, with partner brands showing an increasingly dynamic performance. At the end of June, the mobile prepaid customer base was 23.8 million.

The demand for LTE again significantly increased in the second quarter. 9.4 million Telefónica Deutschland customers now use LTE-enabled devices and corresponding tariffs. This represents an increase of 54 percent over 12 months.

The company also experienced a positive trend in the DSL retail business, where the upward trend seen in the first quarter continued into the subsequent months. The number of retail DSL connections increased by 2,500 in the second quarter. In the Germany-wide DSL fixed-line test conducted by the specialised journal Connect, O2 was able to improve its results despite being measured against tougher standards and was ranked third.

Efficient network investments – increase in the second half of the year expected

CapEx amounted to EUR 212 million in the second quarter representing a decrease of 13 percent year-on-year primarily on the back of more efficient CapEx spend. CapEx will increase in the second half of the year. Free Cash Flow (FCF) was mainly driven by the sale of towers to Telxius and totalled EUR 599 million in the first half of the year.

Consolidated net financial debt amounted to EUR 1.36 billion at the end of June. The leverage ratio came to 0.8 which is in line with the company target and reflects high financial flexibility compared with the industry average.

2016 forecast reiterated

In the current financial year, Telefónica Deutschland will continue moving forward on its path to become Germany's leading digital telco. The focus is increasingly shifting from integration to the digital transformation.

In recent quarters, competition has intensified especially in the non-premium segment. In addition, there are headwinds from effects relating to the development of the customer base as well as from regulatory effects. At the same time, data usage and the LTE customer base continue to grow. We still expect this data growth to drive an inflection point in our mobile service revenue trajectory in the future.

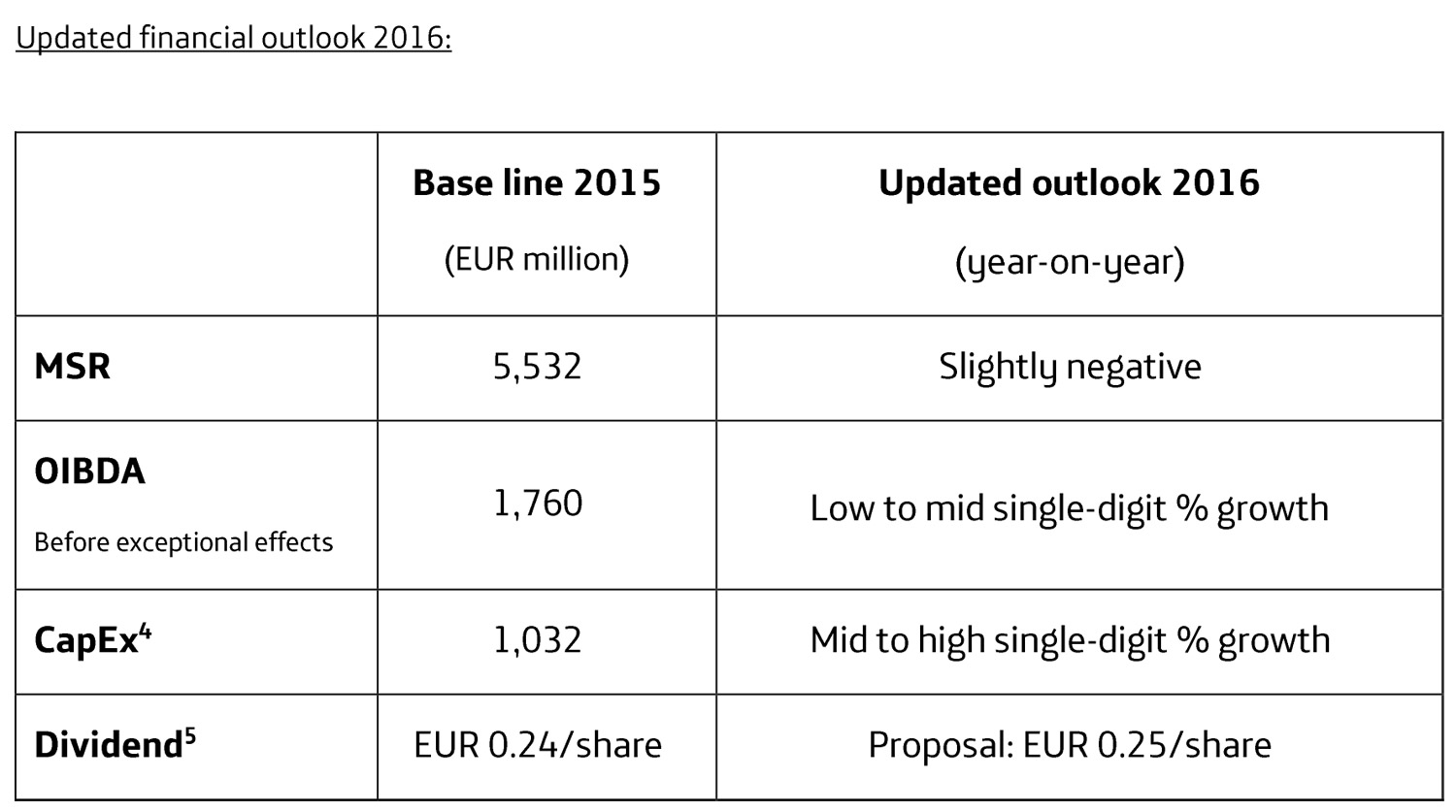

Against this backdrop, Telefónica Deutschland reiterates its mobile service revenue outlook for the full year while narrowing the projected range. Mobile service revenues are now expected to show slightly negative growth in 2016. Telefónica Deutschland continues to expect OIBDA excluding exceptional effects(3) to grow by a low to mid single-digit percentage. The company reiterated its synergy targets for the merger with E-Plus. The outlook for investments (CapEx) before exceptional effects has been updated; CapEx is now expected to merely grow by a mid to high single-digit percentage due to the greater efficiency of network investments.

Telefónica Deutschland has a solid foundation for further improvements in the operating results and free cash flow. Against this backdrop, Telefónica Deutschland expects to be able to pay out an increased dividend of EUR 0.25 per share (previously: EUR 0.24) for the 2016 financial year, with further growth expected for the 2017 and 2018 financial years.

| 1) Excluding exceptional and special effects. As of 30 June 2016 exceptional effects include restructuring expenses amounting to EUR 37 million and the net capital gain from the sale of passive tower infrastructure to Telxius amounting to EUR 352 million, while in the same period of 2015 a one-off gain from the sale of yourfone GmbH was registered. As of 30 June 2016 special effects consist of the impact which the Telxius deal had on OIBDA (EUR -6 million in the first six months of 2016) resulting primarily from higher operating lease expenses starting in May 2016. 2) Average monthly data use (in GB) of O2 customers with LTE-enabled smartphones (all tariffs). 3) Exceptional and special effects are excluded from our guidance. Exceptional effects include the capital gain from the sale of Telefónica Deutschland’s passive tower infrastructure in Q2 2016. The OIBDA impact resulting primarily from higher operating lease expenses between May and December 2016 will also be treated as a special effect for 2016 and thus excluded from our guidance. 4) Excluding investments in spectrum in June 2015 amounting to EUR 1,198m (including capitalised costs on borrowed capital). 5) Proposal to the Annual General Meeting 2017. |