09.05.2019

Preliminary figures1) for the first quarter 2019:Telefónica Deutschland increases revenue as well as number of contract customers and invests in future growth

Photo: Telefónica Germany

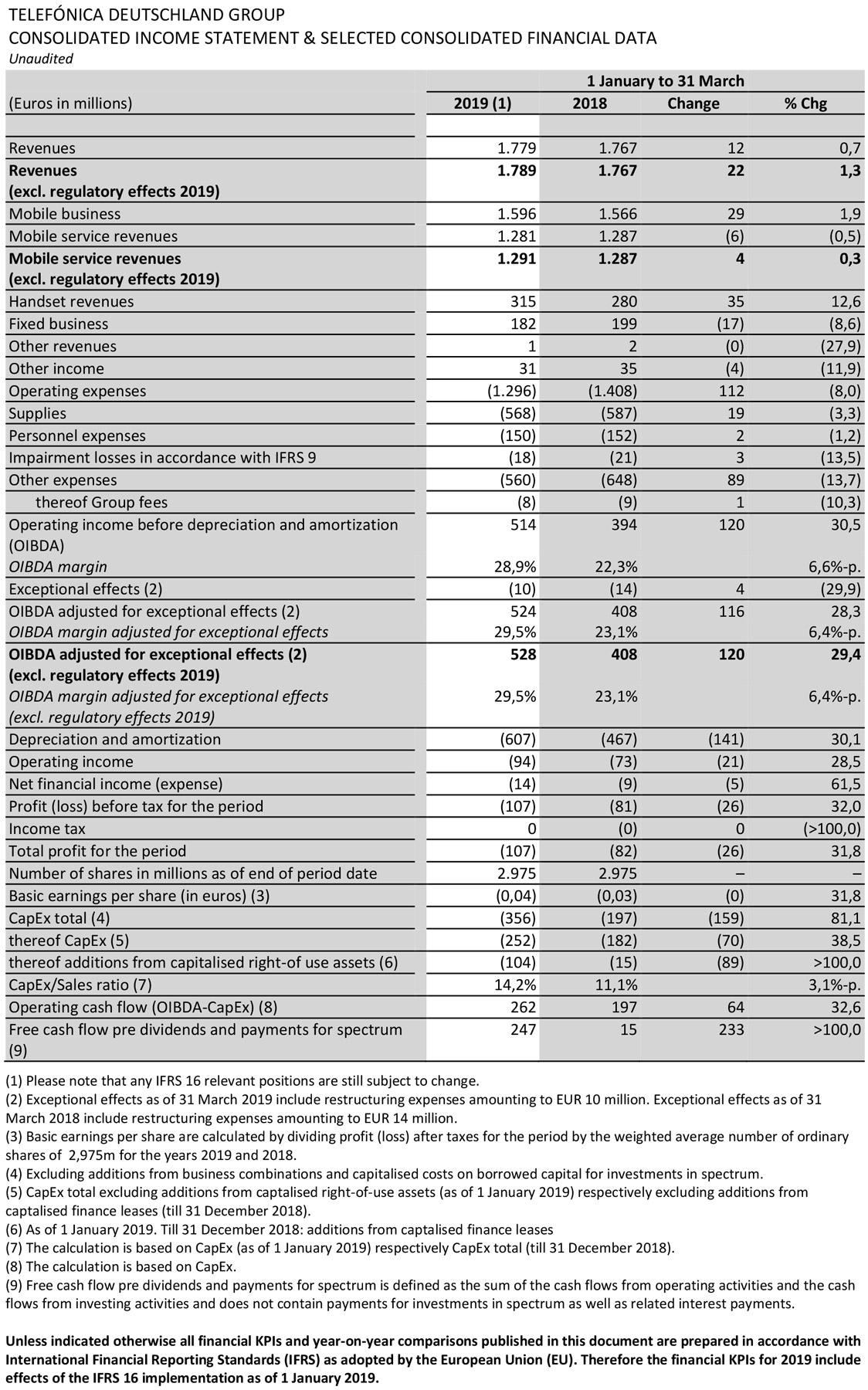

Telefónica Deutschland has started 2019 with a strong momentum and at the same time has laid the foundations for the mobile network of the future. Due to the dynamic partner business and the strong demand for O2 Free tariffs and mobile devices, revenues adjusted for regulatory effects rose by 1.3 percent to EUR 1.79 billion in the first quarter. Operating profit (OIBDA) before exceptional and regulatory effects increased by 29 percent to EUR 528 million, reflecting the transition to IFRS 16 accounting. As a result, the OIBDA margin improved to 29.5 percent. At the same time, the company invested heavily in growth. With 306,000 additional contract customer lines, Telefónica Deutschland continued its momentum in the postpaid segment. The development in the fixed-network business improved further. The company was able to gain an additional 44,000 DSL accesses. With cooperation agreements concerning fibre-optic connection to wireless sites and the access contract to Vodafone's cable network, Telefónica Deutschland has the prerequisites to successfully operate in the markets for mobile communications, fixed network and convergent products in the coming years.

"We have seen a strong start to the year and are now continuing to invest in our infrastructure, our products and the digital transformation of our business," said Markus Haas, CEO of Telefónica Deutschland. "With access to fibre-optic and cable infrastructure, we have all the prerequisites for the network of the future in place."

- First-quarter revenues2) up 1.3 percent

- Adjusted3) OIBDA increases by 29 percent and margin rises to 29.5 percent due to new accounting rules (IFRS 16)

- Number of contract customer connections grows by 306,000

- Growth in DSL lines accelerates to 44,000

- Cable contract with Vodafone enhances fixed-network infrastructure portfolio

More and more contract customers with higher brand loyalty

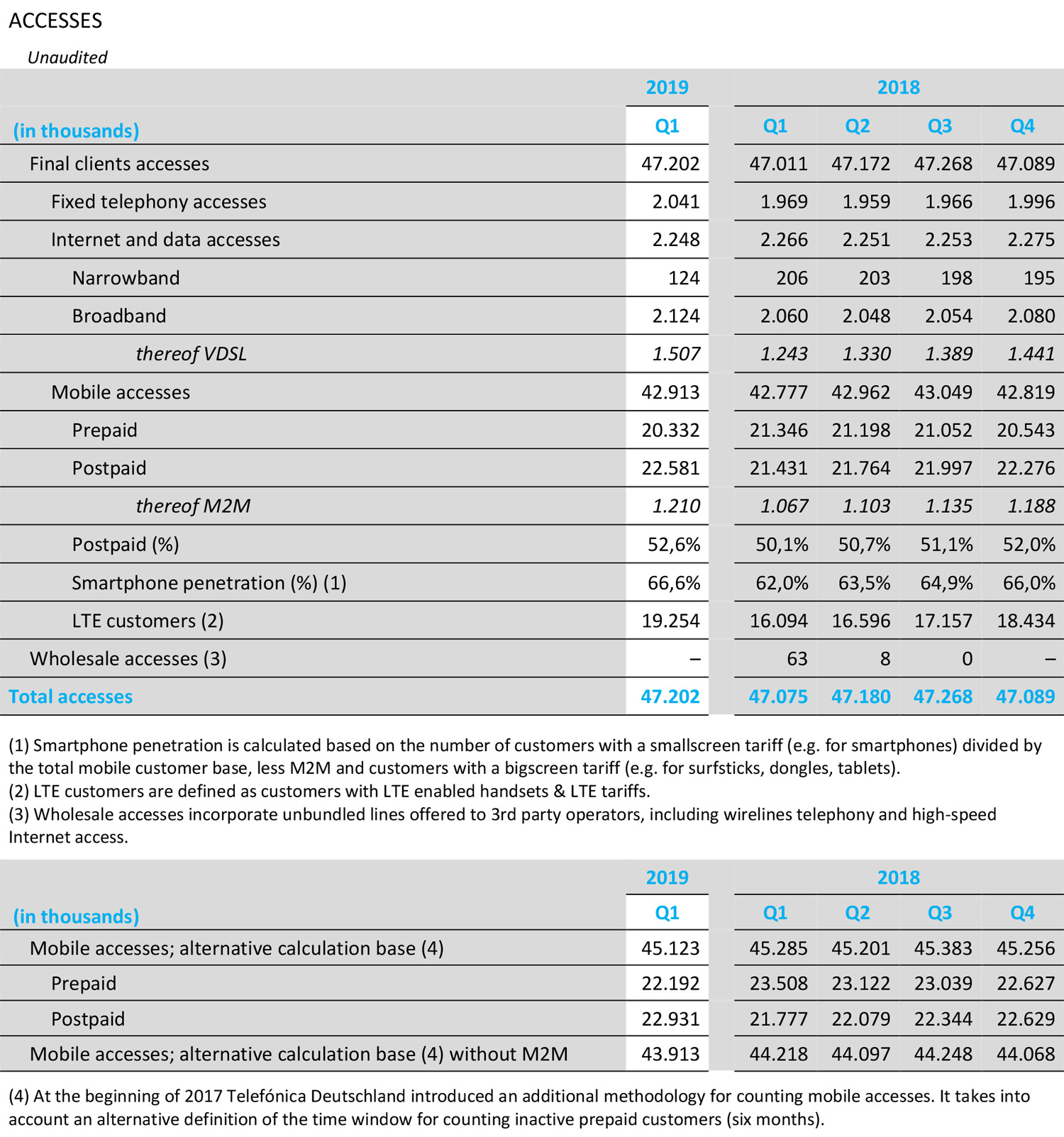

The strong development in customer numbers continued in the first quarter. Thanks to its vibrant partner business and strong demand for O2 Free tariffs, Telefónica Deutschland was able to increase its number of postpaid accesses by 306,000, almost twice as many as in the first three months of the previous year. At the same time, more and more people remain loyal to the company's brands. The churn rate among O2 customers decreased by 0.2 percentage points year-on-year to 1.3 percent.

The fixed-network business is also gaining momentum. The company gained 44,000 DSL retail lines in the first quarter, after losing 12,000 lines in the prior-year period. The growth drivers were the VDSL contracts, the number of which increased by 21 percent to more than 1.5 million within one year.

At the end of March, Telefónica Deutschland had 45.14) million mobile lines and 49.4 million customer lines in total. No mobile network in Germany is used by more people.

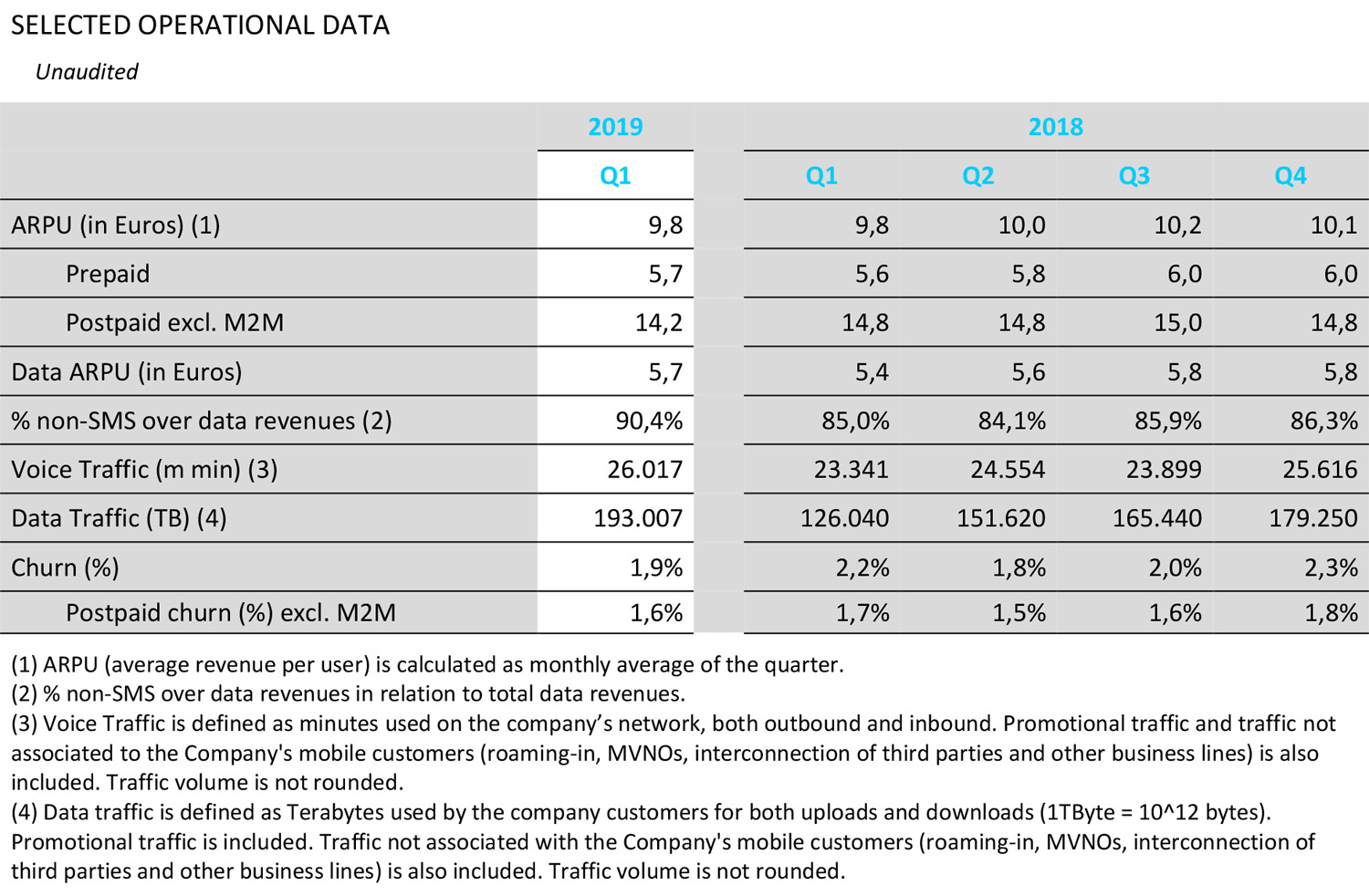

Benefiting from the strong demand for O2 Free tariffs with large data volumes, the dynamics of mobile data growth increased once again: 193,000 terabytes (TB) of data flowed through Telefónica Deutschland's wireless network from January to March, 53 percent more than in the same period last year.

Continued strong demand for handsets

Revenues continued to develop positively in the first quarter, rising by 0.7 percent to EUR 1.78 billion. This was mainly due to the strong sales of O2 Free tariffs and the continued high demand for mobile devices. Excluding the impact of regulatory decisions, in particular the reduction of mobile termination fees, revenue growth was 1.3 percent. On this basis, revenue from mobile communications services grew by 0.3 percent. At EUR 9.80, average revenue per customer remained stable compared with the first quarter of 2018.

Telefónica Deutschland's revenue continues to benefit from strong demand for mobile devices. Sales here amounted to 315 million euros, 13 percent more than a year ago. At the same time, revenues in the fixed-network business fell by 8.6 percent to EUR 182 million because the basis effects from the multi-year exit from the wholesale DSL business were still having an impact.

Investments in growth and transformation

The operating result in 2019 will be strongly influenced by the changed accounting rules in accordance with IFRS 16. The most important change is that leasing costs, especially for antenna sites, are no longer regarded as operating costs but as depreciation. Thus, these expenditures no longer influence OIBDA. At the same time, the capitalisation of wireless sites in the balance sheet augments both fixed assets and debt.

As a result, OIBDA adjusted for exceptional and regulatory effects increased by 29 percent to EUR 528 million in the first quarter, while the corresponding margin improved by 6.4 percentage points to 29.5 percent. On a comparable basis5), adjusted OIBDA increased by 1.0 percent. In the first three months, Telefónica Deutschland invested in the marketing of products and in the transformation of the company in order to continue to achieve profitable growth. Marketing expenses are already reflected in the positive development of customer numbers, while efficiencies from the transformation programme will become more visible later in the year.

In addition to investments in the market, Telefónica Deutschland continued to work on improving its network infrastructure. CapEx rose to EUR 252 million in the first quarter from EUR 182 million in the same period of the previous year as a result of the further intensified expansion of LTE. This resulted in a ratio of CapEx to revenue of 14.2 percent.

The net result for the period amounted to minus EUR 107 million, after minus EUR 82 million in the same quarter of the previous year. The reason for this development was shortened depreciation periods in the course of the completion of grid integration. Free cash flow (FCF) improved from EUR 15 million in the prior-year quarter to EUR 247 million, driven by the introduction of IFRS 16. The rent prepayments to be capitalised under IFRS 16 amounted to EUR 257 million.

Consolidated net financial liabilities amounted to EUR 3.66 billion at the end of March due to the capitalization of leases for wireless sites in accordance with IFRS 16 rules. However, the items within net financial debt affected by IFRS 16 are liable to change within a range of minus 5 percent and plus 5 percent. While the leverage ratio under IAS 17 was 0.6x as of March 31, 2019 and was thus within the self-defined target range, extrapolation under IFRS 16 would result in a gearing ratio 1.0x to 1.1x above that.

LTE expansion continues unabated

Photo: Telefónica Germany

In the course of this year, Telefónica Deutschland has continuously expanded its mobile communications network and, in particular, further increased the expansion of LTE. In the first three months alone, the company built more than 2,200 new LTE sites or upgraded existing ones. By the end of the year, 10,000 sites are to be upgraded.

Beyond LTE, Telefónica Deutschland is also ideally equipped for the future. On the one hand, numerous cooperative ventures to connect mobile masts with fibre-optic lines provide for a significant improvement in network performance.

In addition, Telefónica Deutschland also has extended options in the fixed network: The agreement on access to the German cable network of Vodafone and Unitymedia ensures that the company's customers will be able to use high-quality Internet services for years to come.

In the ongoing frequency auction, the company wants to secure valuable spectrum for the 5G mobile communications standard, which will shape the company's future mobile communications infrastructure until 2040.

Telefónica Deutschland has been offering a DSL connection of 250 megabits per second with the O2 my Home XL tariff since March. O2 TV provides TV entertainment with more than 100 channels both at home and on the move. And O2 Free customers are also offered more: They are now able to surf at LTE speed even after their inclusive data volume has been used up. And with the new O2 Cloud, customers get unlimited storage space for photos, videos, music, documents and other files.

Outlook confirmed after strong start to 2019

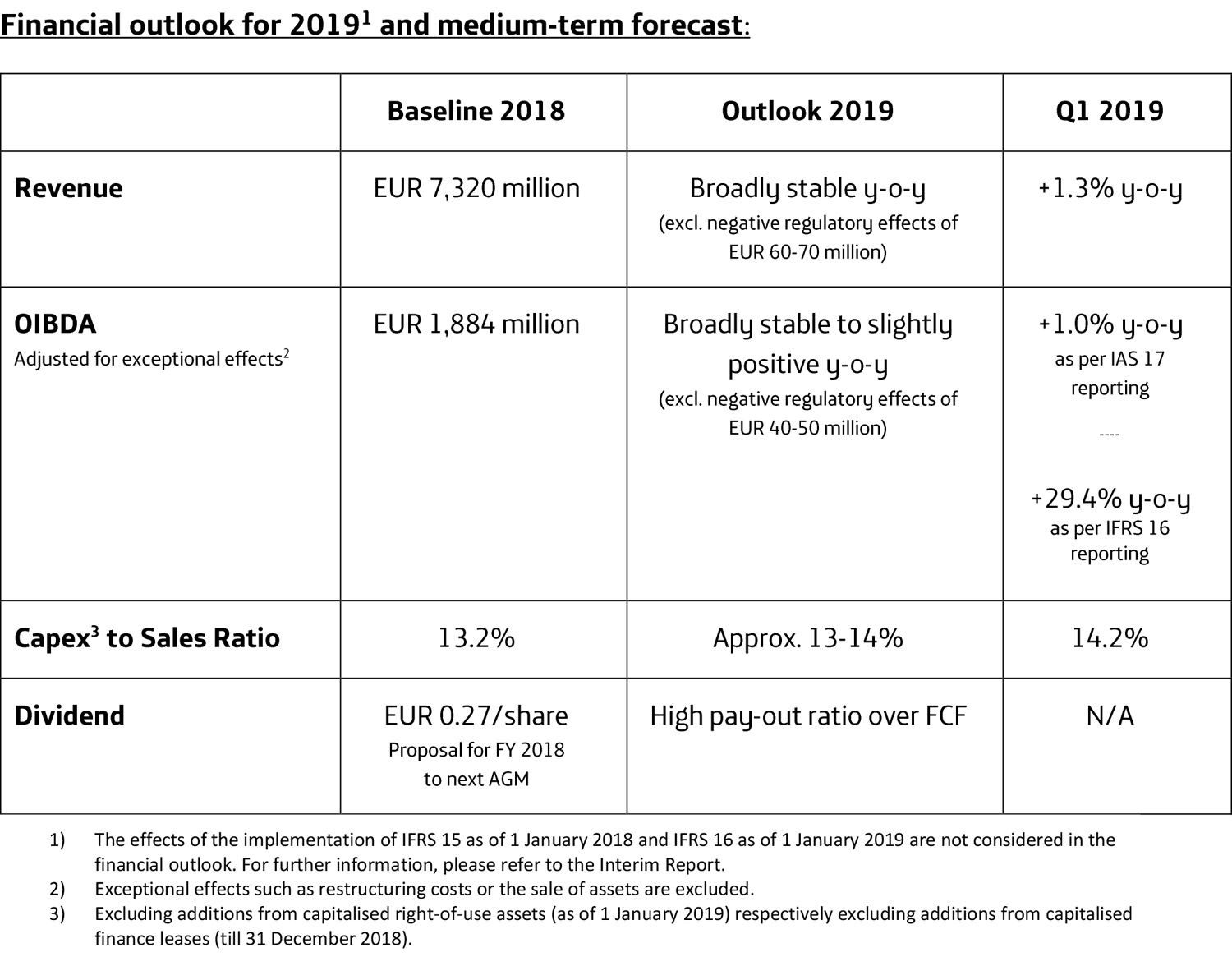

In view of the business development in the first quarter, Telefónica Deutschland confirms its outlook for the full year. The table below provides details of the financial outlook.

Note: Unless indicated otherwise, all financial KPIs and year-on-year comparisons published in this document are prepared in accordance with IFRS accounting standards as adopted by the European Union. Financial KPIs for 2019 therefore include the effects of the implementation of IFRS 16 as of 1 January 2019.

| 1) | Unless otherwise stated, the financial data and comparative figures published in this document have been prepared in accordance with the International Financial Reporting Standards (IFRS) adopted by the European Union (EU). Accordingly, the key financial figures for 2019 include the effects of IFRS 16 implementation as of January 1, 2019. |

| 2) | Regulatory effects at revenue level amounted to EUR 11 million from January to March 2019. |

| 3) | Exceptional effects from January to March 2019 include restructuring expenses of EUR 10 million. Regulatory effects at OIBDA level amounted to EUR 4 million during this period. |

| 4) | On the basis of alternative calculation methods. |

| 5) | In accordance with IAS 17 accounting standards. |