20.02.2019

Preliminary figures1) for the fourth quarter and fiscal year 2018:Telefónica Deutschland achieves growth in revenue, profits and postpaid customers in 2018

- Revenues2) up 0.9 percent from 2017; strongest quarter in three years

- Adjusted3) OIBDA rises 5.3 percent year-on-year to new record level

- More than 1 million contract customer accesses added in 2018

- Number of fixed-network lines returning to growth thanks to demand for VDSL

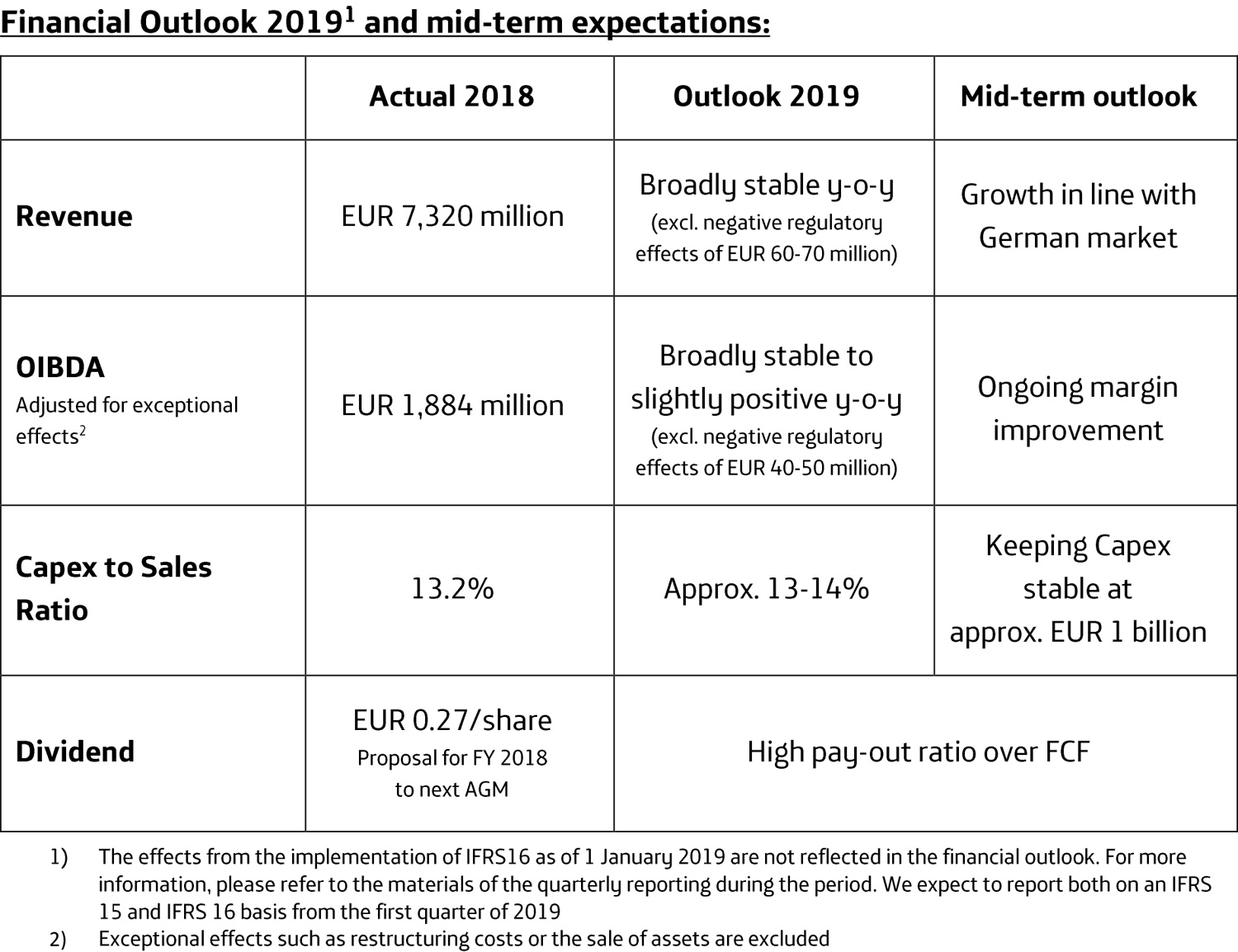

- Outlook 2019: Revenues broadly stable before regulatory effects; adjusted OIBDA broadly stable to slightly positive

- Markus Haas: "Following the completion of the largest merger in European mobile communications history, we now have the most modern network in Germany and are better positioned than ever before. This year, we want to build on this operational momentum by transforming ourselves into the Mobile Customer & Digital Champion."

In the 2018 financial year, Telefónica Deutschland achieved its targets and essentially completed the integration of E-Plus. Excluding regulatory impact, revenue increased by 0.9 percent. This was primarily due to the strong end device business and the sustained strong demand for mobile tariffs with large data volumes. The operating result (OIBDA) continued to develop positively, in part thanks to the thorough realization of synergies. Adjusted for special and regulatory effects, it rose by 5.3 percent year-on-year to EUR 1.94 billion. The number of customers also showed a strong development. Telefónica Deutschland increased the number of mobile contract customer accesses by more than 1 million in 2018. In the fixed business, the company returned to growth thanks to strong demand for VDSL lines. For the current financial year, the company expects a steady development of its financial results. Before regulatory effects, revenue is expected to remain broadly stable. Adjusted for exceptional and regulatory effects, OIBDA should be broadly stable to slightly positive.

"Following the completion of the largest merger in European mobile communications history, we now have the most modern network in Germany and are better positioned than ever before," said Markus Haas, CEO of Telefónica Deutschland. "This year, we want to build on this operational momentum by transforming ourselves into the Mobile Customer & Digital Champion.”

Further strong growth in contract customers and data usage

Markus Haas

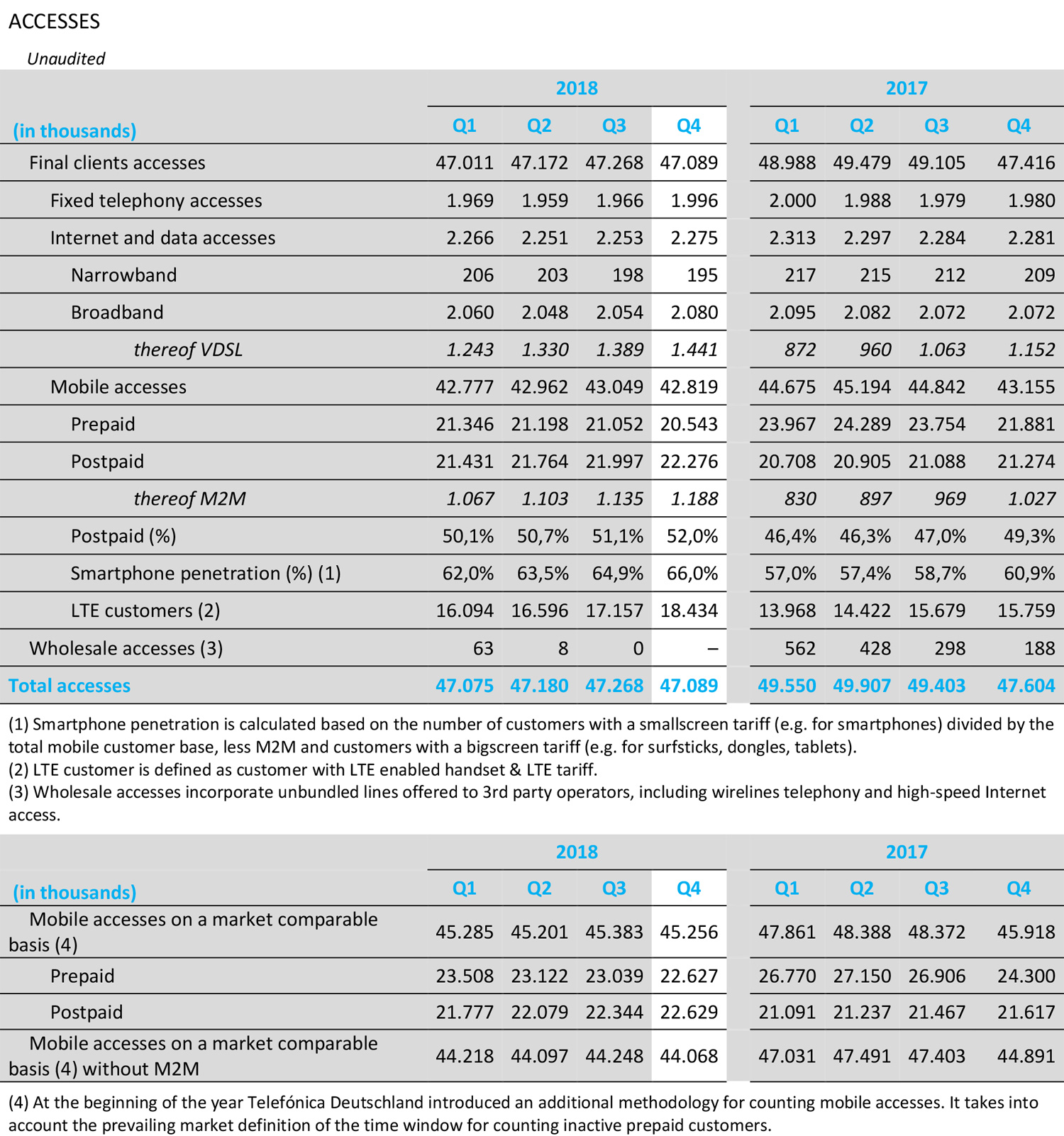

Last year, Telefónica recorded further strong growth in mobile postpaid customers and was also able to initiate a turnaround in fixed-network lines. Driven by strong demand for O2 Free tariffs, the number of mobile postpaid accesses increased by 279,000 in the fourth quarter alone. For the whole year, the increase was just over 1 million, significantly more than the gains from 2017 (737,000). The churn rate among O2 postpaid customers decreased from 1.5 percent to 1.4 percent during this period. The number of prepaid customers continued to decline over the course of the year, primarily due to stricter registration requirements.

In the fixed business, Telefónica Deutschland returned to customer growth around the middle of the year. In the fourth quarter, the number of home lines increased by 1.2 percent to 4.27 million compared with the end of September, of which 2.1 million were retail broadband lines. The positive development was mainly due to the growing demand for VDSL lines.

At the end of the year, the number of mobile accesses served by Telefónica Deutschland was 45.34) million. This means that the company remains the number one in the German market in terms of the number of people using its network. Including the fixed network, it recorded 49.5 million accesses.

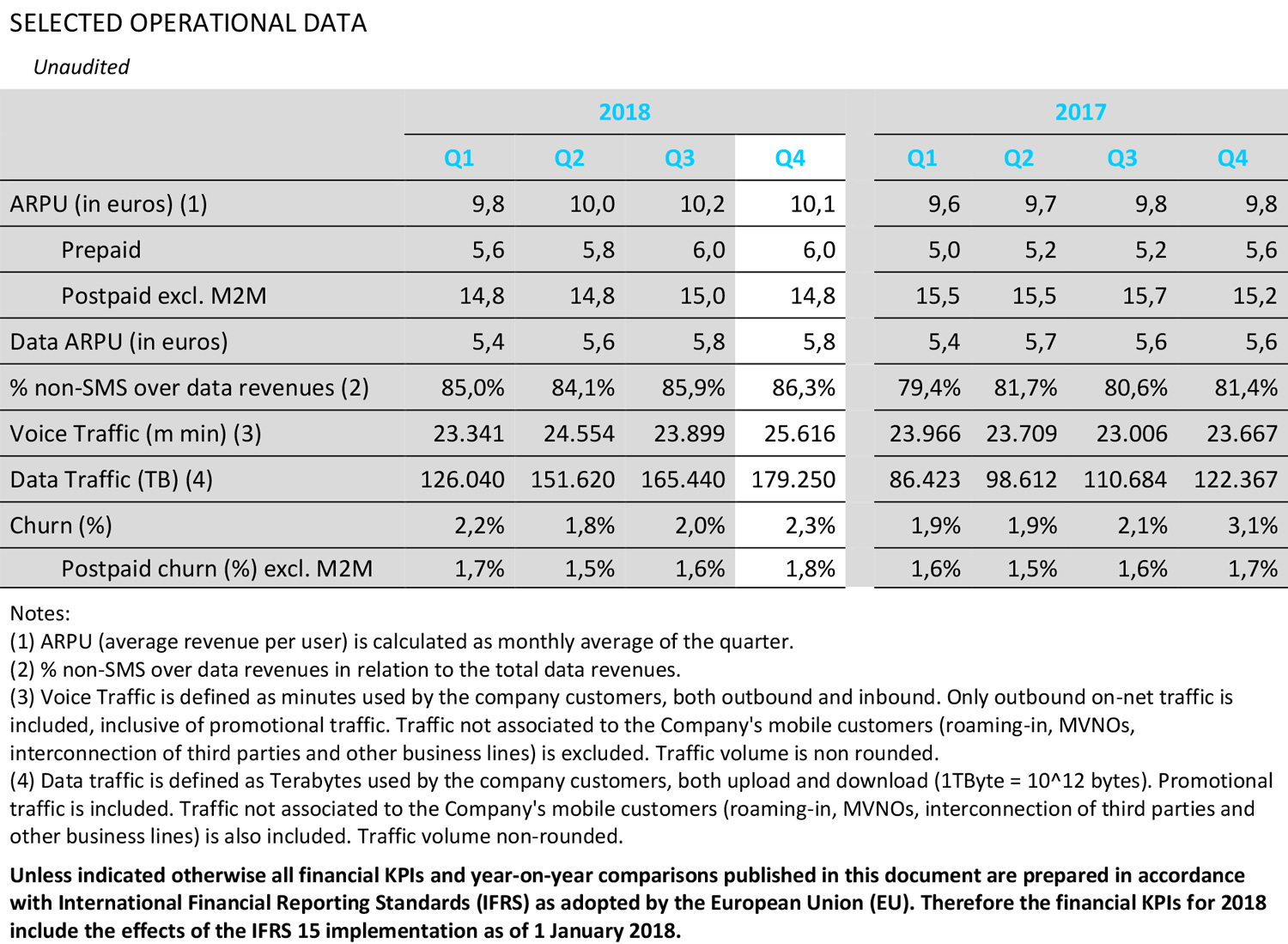

The demand for data remains unbroken in view of the trend toward mobile use of photos, videos and music. Data traffic in Telefónica Deutschland's mobile communications network again grew rapidly in 2018 – by 49 percent to 622,300 terabytes (TB). On average, O2 postpaid customers already used 4.1 gigabytes (GB) per month during the fourth quarter, 47 percent more data volume than in the year-earlier period.

Largest quarterly revenue in three years

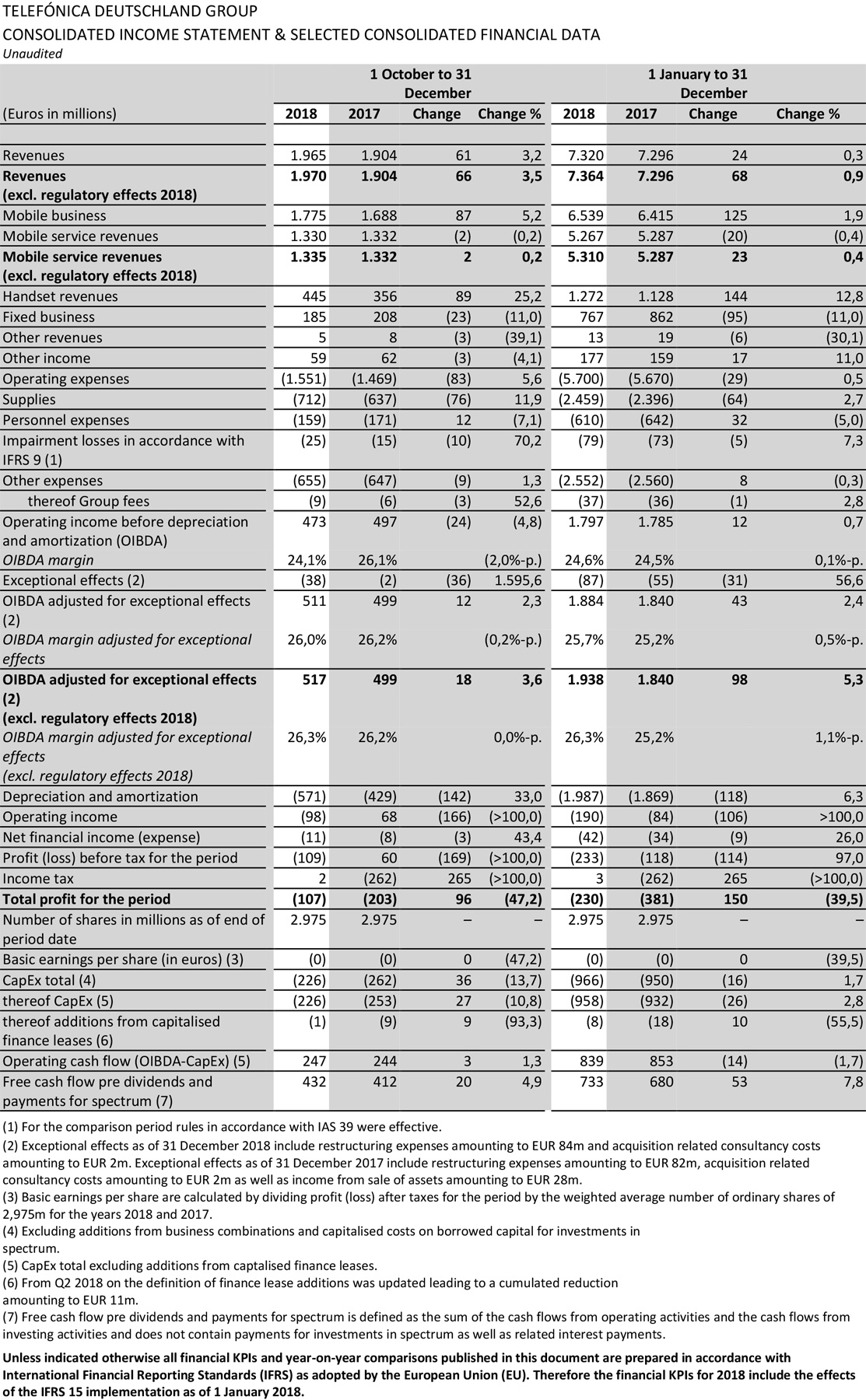

Thanks to its strong operational performance, the company was able to increase its revenues versus the previous year. Despite the impact of the abolition of European roaming charges and a reduction in mobile termination rates (MTR), revenues grew by 0.3 percent to EUR 7.32 billion. Without these effects, the increase would have been 0.9 percent. In the past three months, the company generated its strongest revenues since the fourth quarter of 2015.

Revenue from mobile communications services benefited from demand for O2 Free tariffs and, adjusted for regulatory effects, improved by 0.4 percent in 2018. Including these effects, there was a decrease of 0.4 percent to EUR 5.27 billion. Average revenue per mobile user (ARPU) improved by 3.1 percent year-on-year to EUR 10.

Due to high demand for smartphones, sales of terminal devices developed extremely strongly last year, rising by 13 percent to EUR 1.27 billion.

The fixed-network business recorded revenue of EUR 767 million in 2018, a decline of 11 percent. The exit from the wholesale DSL business was still noticeable in the year-on-year comparison.

Further increase in profitability thanks to synergies

Thanks to sales growth and synergies from the merger with E-Plus, Telefónica Deutschland generated a higher operating result than in the previous year. Adjusted for exceptional and regulatory effects, OIBDA rose by 5.3 percent to EUR 1.94 billion in the fiscal year, an all-time high. The company thus improved its profitability margin by 1.1 percentage points to 26.3 percent. Including regulatory effects, the increase in OIBDA was 2.4 percent.

In 2018, Telefónica Deutschland completed its network integration and upgraded its LTE network. Investments (CapEx) increased by 1.7 percent to EUR 966 million. CapEx thus amounted to 13.2 percent of revenue.

The profit for the period improved from EUR minus 381 million to EUR minus 230 million, driven by the increase in operating profit. Free cash flow (FCF) increased by 7.8 percent year-on-year to EUR 733 million.

Consolidated net financial debt at the end of December was EUR 1.13 billion. The leverage ratio came to 0.6x, in line with our leverage target of at or below 1.0x.

Significant network improvements and freedom offensive

Telefónica Deutschland not only completed the integration of the E-Plus network in the past fiscal year, but also upgraded its network considerably more than its competitors with 6,700 LTE stations. In the course of the year, the company covered an additional area larger than the federal state of Lower Saxony with LTE for the first time and thereby reached an additional 5.5 million people with this broadband technology.

As a result, the company was able to catch up in terms of network quality, as also confirmed by well-known network tests in the fourth quarter: The nationwide CHIP network test certified Telefónica Deutschland made a "quantum leap.” In the reader network test of COMPUTER BILD, in which quality, stability, speed and reliability were rated, Telefónica Deutschland achieved 4.6 of 5 stars. The connect network test also found a massive improvement in network quality.

In order to further improve the connection speed for customers and create the basis for a 5G network, Telefónica Deutschland concluded numerous cooperation agreements in 2018 to connect mobile masts with fiber optic cables. Agreements with Deutsche Telekom, GasLINE and Unitymedia were added in the fourth quarter. At the end of December, Nokia and Telefónica Deutschland completed the establishment of their joint Early 5G Innovation Cluster in Berlin. In Hamburg, the test of fixed wireless access technology that the company is conducting with Samsung offers a promising building block for the next generation network.

In recent months, the company has introduced numerous new tariffs that enable its customers to combine mobile freedom with a powerful fixed network connection. Since November, the O2 Business Fusion package has been available for business customers, combining an all-in-one rate with tailored round-the-clock support. Telefónica Deutschland added the convergent O2 my All in One XL rate with 60 GB fast mobile data volume to its O2 portfolio for residential customers at the beginning of February. The company thus remains the leader in the area of particularly large data packages for the broad market.

Telefónica expects steady business development in 2019

In the current financial year, Telefónica Deutschland will continue its successful multi-brand and multi-channel strategy. The company expects a stable price development in both the premium and the non-premium segments. While the postpaid business will continue to be the strongest value creation driver, the company expects a further weakening of demand for prepaid tariffs. The reasons for this are the stricter registration requirements introduced in 2017 and a shift in customer interest towards mobile contracts.

Regulatory effects will continue to have a negative impact on corporate results in 2019. The largest share of this will probably be attributable to the reduction in mobile termination charges from 1.07 cents to 0.95 cents as of December 1, 2018 as well as cost limits for calls and SMS within the European Union, which are set to come into force on May 15. In addition, the abolition of roaming charges in the EU continues to have a negative impact. These effects are expected to negatively affect revenue by EUR 60-70 million and OIBDA by EUR 40-50 million.

Excluding these effects, the company expects revenue to remain broadly stable in 2019 and adjusted OIBDA to be broadly stable to slightly positive. Capital expenditures are expected to account for 13-14 percent of revenues, with the company planning to build an additional 10,000 LTE stations in 2019. In the course of the fiscal year, the company will introduce the new IFRS 16 accounting rules and target a higher leverage ratio that will allow flexibility for the upcoming investments in 5G. As part of the transformation, in 2019 the company will introduce instruments to improve churn and improve its revenue potential by optimizing its sales channels, among other things.

Telefónica Deutschland reaffirms its intention to grow in line with the German market in the medium term, further improve its OIBDA margin and keep annual investments stable at around EUR 1 billion. In addition, the company continues to forecast a high payout in terms of free cash flow. The table below provides details of the financial outlook.

Note: Unless indicated otherwise, all financial KPIs and year-on-year comparisons published in this document are prepared in accordance with IFRS accounting standards as adopted by the European Union. Financial KPIs for 2018 therefore include the effects of the implementation of IFRS 15 as of 1 January 2018.

| 1) | Unless indicated otherwise, all financial KPIs and year-on-year comparisons published in this document are prepared in accordance with IFRS accounting standards as adopted by the European Union. Financial KPIs for 2018 therefore include the effects of the implementation of IFRS 15 as of 1 January 2018. |

| 2) | Regulatory effects at revenue level amounted to EUR 44 million from January through December 2018. |

| 3) | Exceptional effects were EUR 84 million of restructuring expenses (mostly in other expenses) and EUR 2 million of consultancy fees in the context of corporate transactions in the period January to December 2018. Regulatory effects at OIBDA level amounted to EUR 54 million during this period. |

| 4) | According to market-comparable calculations. |