12.05.2021

Interim announcement on the first quarter of 2021: Telefónica Deutschland / O2 continues to grow profitably at the start of 2021

- Telefónica Deutschland / O2 with good operational and financial momentum in the first quarter of the fiscal year despite headwinds from COVID-19 pandemic

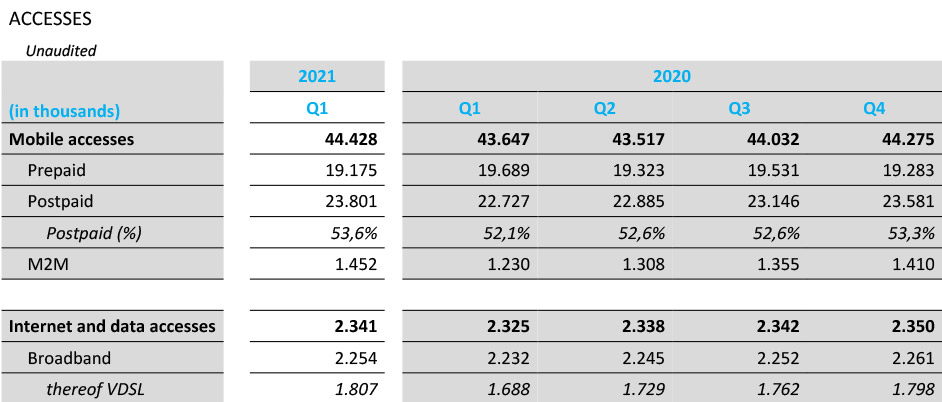

- Number of mobile postpaid accesses grows with 262,000 net additions thanks to continued strong interest in core O2 brand

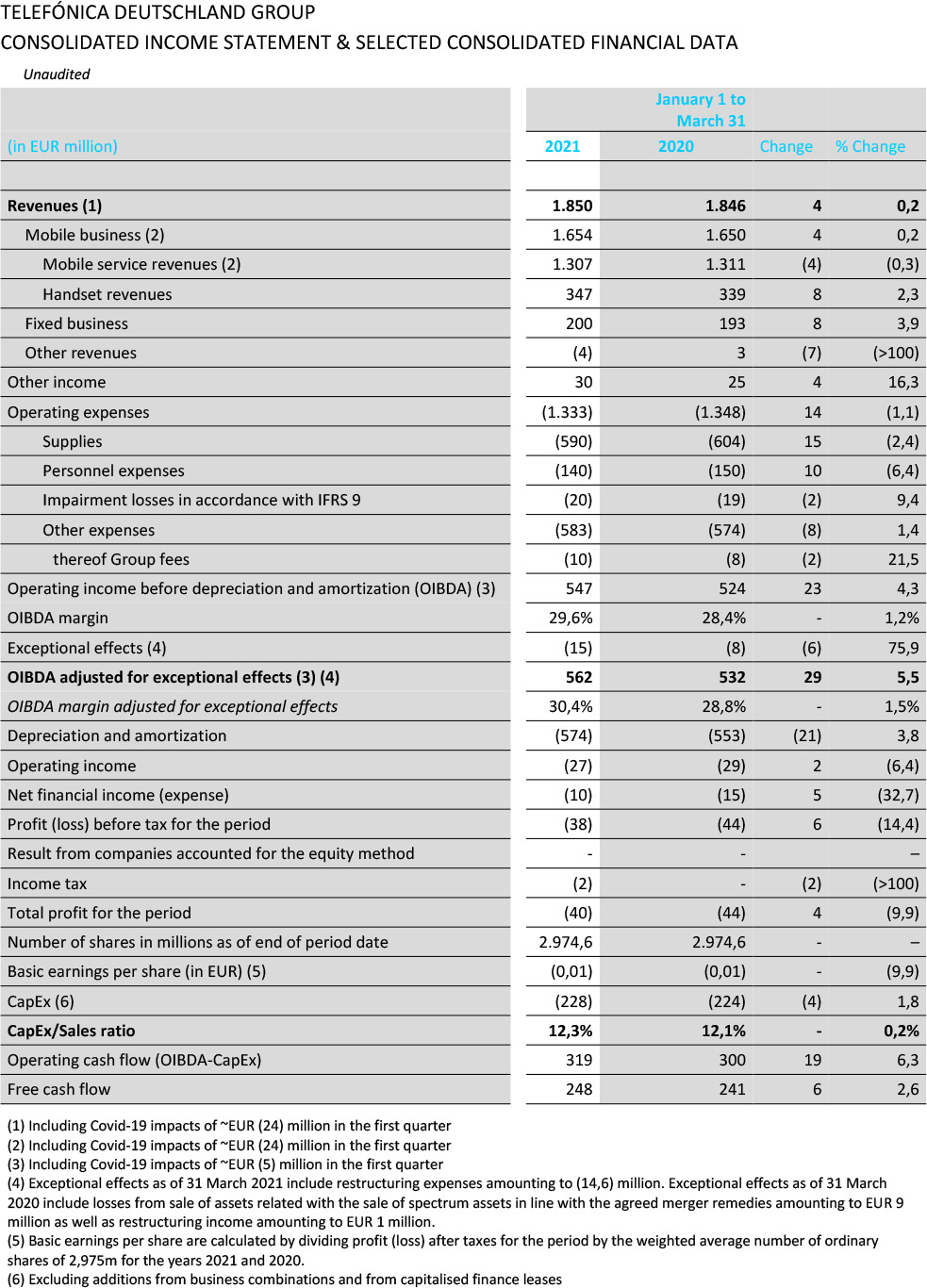

- Revenue up 0.2 percent to 1.85 billion euros during ongoing hard lockdown (up 1.5 percent adjusted for COVID-19 effects)

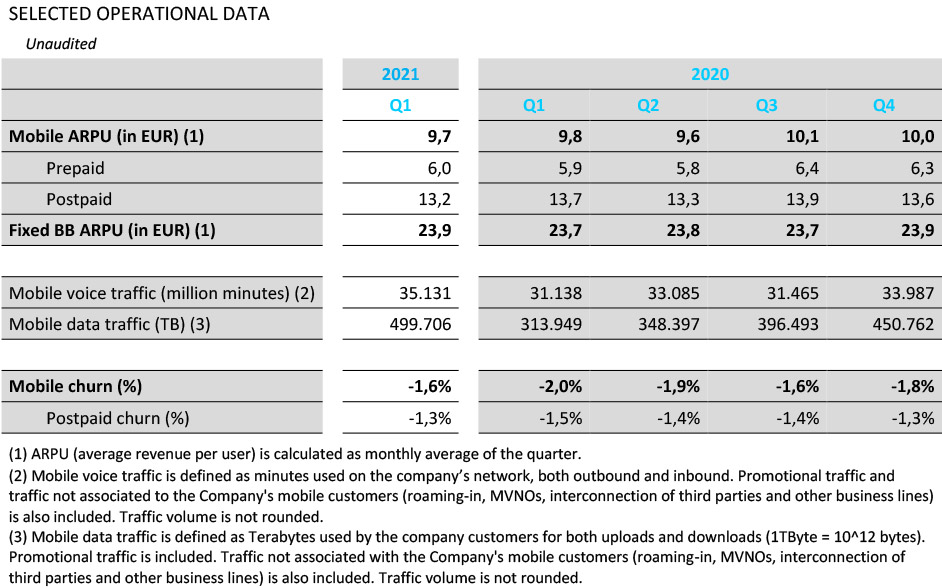

- Mobile service revenues down 0.3 percent to 1.31 billion euros, mainly due to roaming restrictions; operational momentum in-tact thanks to strong core brand and solid partner business

- Revenue from handsets climbs 2.3 percent to 347 million euros with continued strong demand for high value handsets

- Fixed-network revenues grow by 3.9 percent to 200 million euros driven by growth in VDSL customer base

- Strong adjusted operating income OIBDA up 5.5 percent (up 6.4 percent adjusted for COVID-19 effects), as a result of improved revenue quality and effective C-19 cost management

- Continued high investment in network and services amounting to 228 million euros

- Outlook for fiscal 2021 confirmed

- Telefónica Deutschland CEO Markus Haas: "We have made a good start to the current fiscal year despite the continuing major challenges posed by the COVID-19 pandemic. We continued to grow profitably in the first quarter, again demonstrating our operational and financial strength. The investments in our network and service are paying off. We confirm our targets for 2021. We continue to go full steam ahead with our investments and network expansion.”

Markus Haas

Telefónica / O2 got off to a good start in the 2021 financial year. Despite headwinds from COVID-19 effects, the company grew profitably in the first quarter of 2021. Driven by continued strong operating momentum across all businesses, revenues increased 0.2 percent to 1.85 billion euros and adjusted operating income OIBDA grew 5.5 percent to 562 million euros. Revenue and earnings development were primarily impacted by lower roaming revenue due to international travel restrictions. Other COVID-19 effects partially offset this development. Adjusted for COVID-19 effects, revenue increased by 1.5 percent and OIBDA by 6.4 percent. The number of mobile postpaid customers again developed strongly, increasing by 262,000. This development was driven by continued high interest in the core O2 brand and a continued low churn rate of 1.0 percent among mobile contract customers.

"We have made a good start to the current fiscal year despite the continuing major challenges posed by the COVID-19 pandemic," said Markus Haas, CEO of Telefónica Deutschland. "We continued to grow profitably in the first quarter, again demonstrating our operational and financial strength. The investments in our network and service are paying off. We confirm our targets for 2021. We continue to go full steam ahead in our investments and network rollout."

Investments in the 5G network

The 5G network now operates in over 30 German cities with around 1,000 5G antennas.

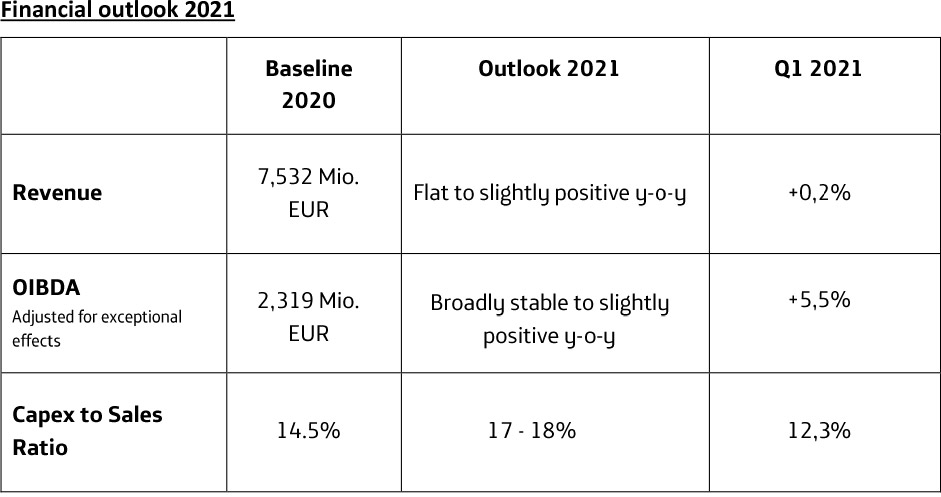

In the first quarter, the company invested 228 million euros in the expansion of its networks and services. The investment ratio, i.e. the ratio of capex over sales, was 12.3 percent. Telefónica Deutschland / O2 has set itself an ambitious investment program for the years 2020 to 2022, in which up to 17-18 percent of revenue is to be invested at peak times. In the current fiscal year, the focus of investment will again be on the second half of the year. Following the largest 4G network expansion program in the company's history with over 11,000 new 4G transmitters in the previous year, the company has greatly expanded its 5G network in parallel in recent months.

The 5G network now operates in over 30 German cities with around 1,000 5G antennas. O2 is currently using only the most powerful 5G variant in the frequency range around 3.6 gigahertz (GHz) in order to offer its customers the greatest possible capacities and at the same time create the conditions for using genuine 5G applications. By the end of 2021, more than 30 percent of the population will benefit from the new mobile technology. By 2025, coverage of the entire country is planned.

Further customer growth in mobile communications

Growth in mobile postpaid customers

The investments in the 4G network, with coverage of 99 percent of the German population, and the roll-out of the 5G network are paying off and resulting in further growth in mobile postpaid customers. With an increase of 262,000 accesses, the churn rate was a historically low 1.3 percent on average per month. At the core brand O2, this figure was even lower at just 1.0 percent. The business customer segment again developed positively.

Operating momentum intact

Adjusted operating income (OIBDA) grew by 5.5 percent

Mobile service revenue decreased by 0.3 percent to 1.31 billion euros, mainly due to restrictions in roaming business and fewer prepaid pack bookings. Revenue from terminal equipment climbed by 2.3 percent to 347 million euros thanks to continued strong demand for high-quality cell phones. Fixed-network revenue climbed 3.9 percent to 200 million euros, driven by growth in the VDSL customer base in previous quarters.

Adjusted operating income (OIBDA) grew by 5.5 percent and by 6.4 percent adjusted for COVID-19 effects to 562 million euros, benefiting from higher revenue quality and effective cost management, among other factors. Lower costs associated with reduced trading activities as a result of the lockdowns also contributed to the earnings growth. These positive earnings effects were partially offset by lower earnings contributions as a result of lower roaming revenues.

Outlook for the 2021 financial year confirmed

The company confirmed its outlook for the current fiscal year 2021

The company confirmed its outlook for the current fiscal year 2021. Accordingly, Telefónica / O2 expects revenues to be flat to slightly positive compared to the previous year and OIBDA to be broadly stable to slightly positive. The investment ratio is expected to be up to 17-18 percent in the current year. The company also confirmed its medium-term forecast for the years 2020 to 2022, during which time Telefónica Deutschland aims to achieve cumulative revenue growth of at least 5 percent and a sustained improvement in margins.

Further detailed information on the financial result is available at: https://www.telefonica.de/financial-publications