26.07.2017

Preliminary figures for Q2 2017:

Telefónica Deutschland posts strong second-quarter growth in customer numbers

- Company added 518,000 mobile subscriptions and retains wireless market leadership

- OIBDA excluding exceptional effects1) rose 5 percent despite regulatory effects; improvement vs. first quarter

- Mobile service revenue excluding regulatory effects down 0.4 percent; positive trend persists

- Continued dynamic growth in data revenues

- Full-year projections for 2017 confirmed

- CEO Markus Haas: "We remain the undisputed number one in the German wireless market. In the first half of the year we were again able to expand our customer base significantly. This shows how successful our business model is.”

Markus Haas, CEO of Telefónica Deutschland

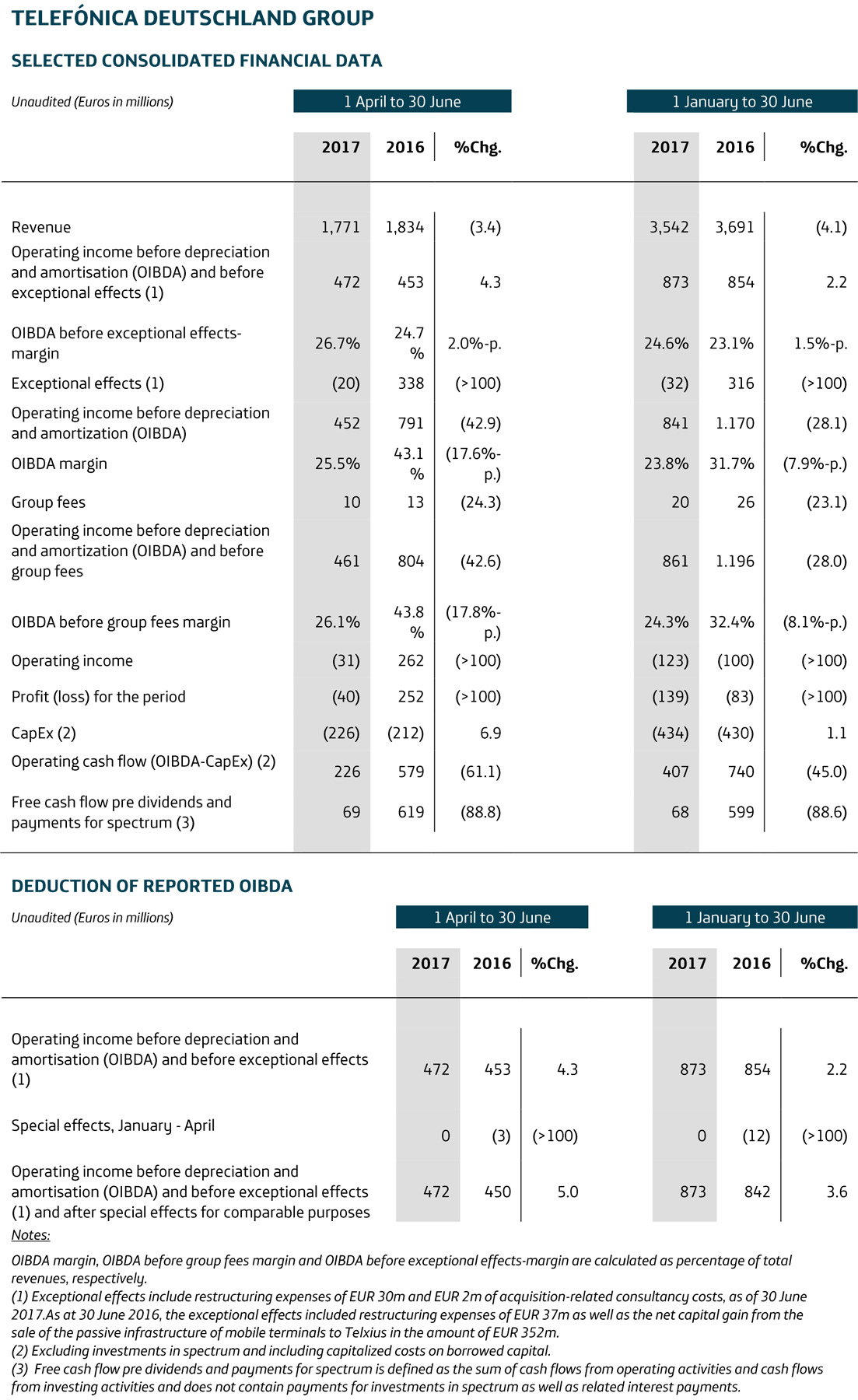

Telefónica Deutschland continued the positive trend from the first three months of the year in the second quarter and made good operational progress amid an intensely competitive market environment. As a result, the company is fully on track after the first half of the year to achieve its targets for 2017. Growth in the number of mobile subscriptions was very strong, with a substantial increase of 518,000 in the second quarter thanks to strong demand for tariffs from the O2 and Blau brands. At the same time, average data usage rose, resulting in a significant increase in data revenue. The first-half performance was impacted by the expected regulatory headwinds, above all by the reduction in mobile termination rates. Nonetheless, Telefónica Deutschland achieved a stronger increase in operating profit in the second quarter of 2017 than in the previous three-month period. Adjusted OIBDA climbed 5 percent to EUR 472 million. In terms of sales, the positive trend seen in the preceding quarters continued as well. Second-quarter mobile service revenues (MSR) excluding regulatory effects continued to stabilize with a decrease of just 0.4 percent.

"We remain the undisputed number one in the German wireless market. In the first half of the year we were again able to expand our customer base significantly. This shows how successful our business model is”, said Markus Haas, the CEO of Telefónica Deutschland. “Despite the substantial burdens from regulation and the intense competition that still prevails in the market, we were able to post a strong set of results in the second quarter.”

Network and offers ensure strong growth in customer numbers

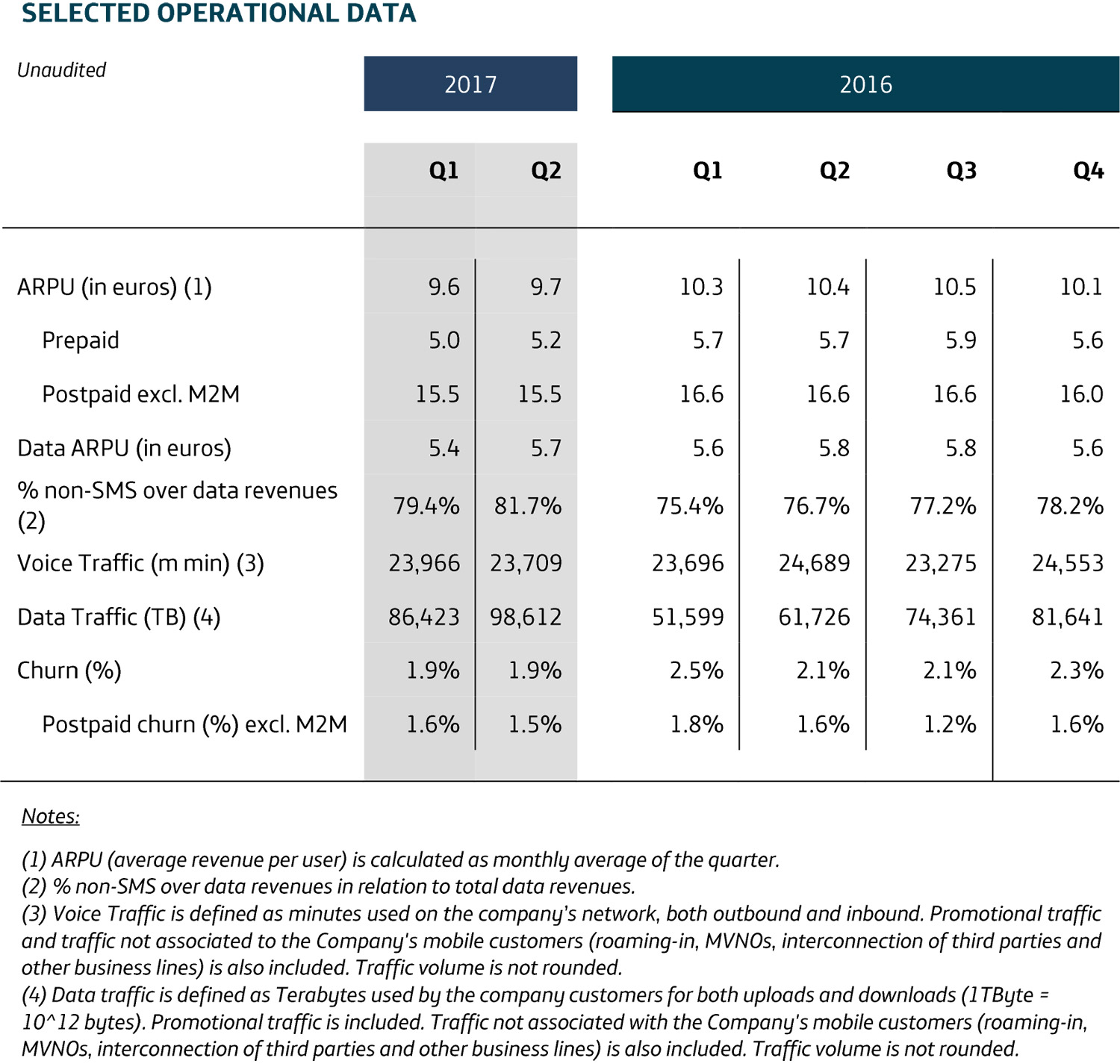

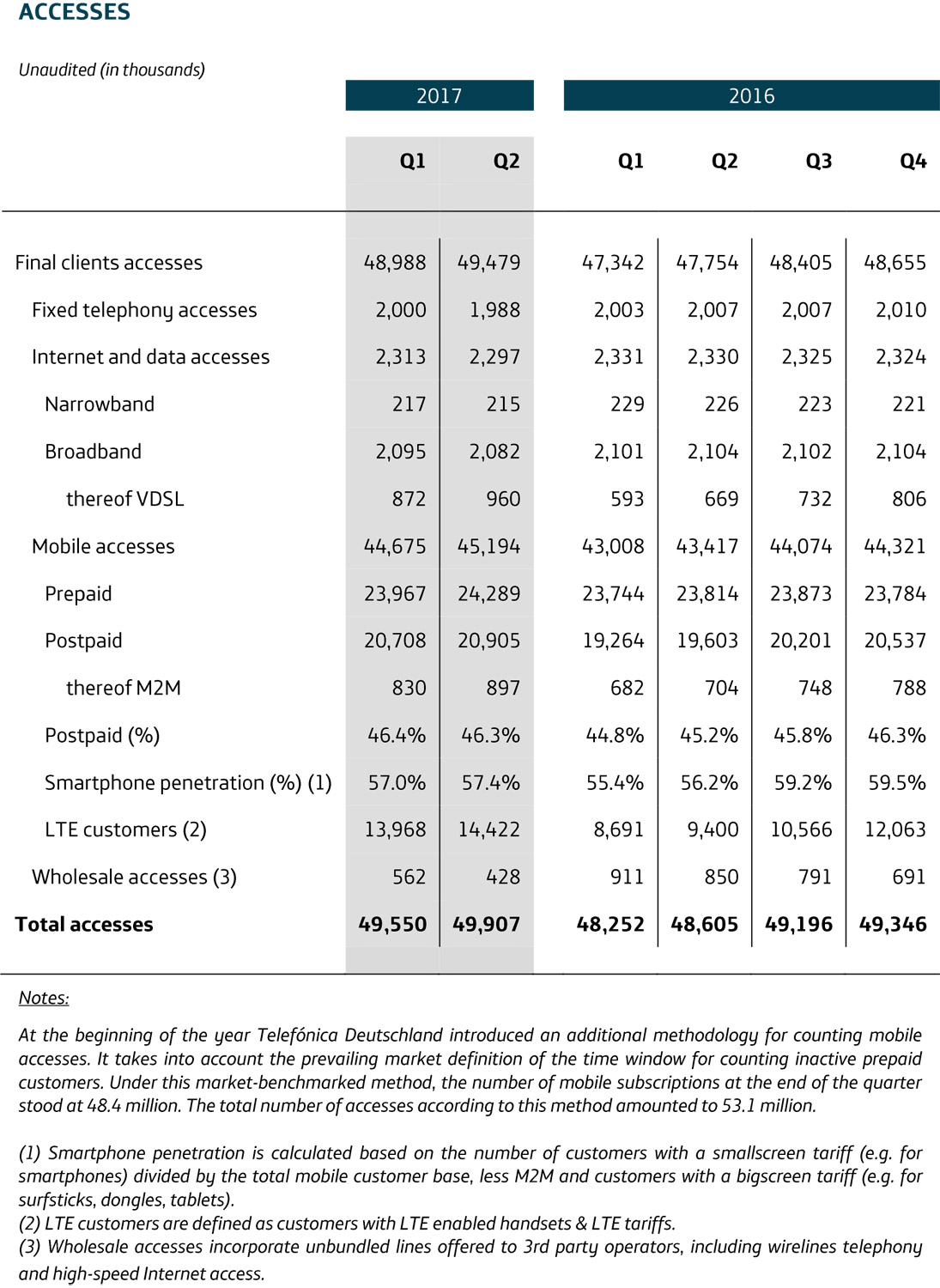

Telefónica Deutschland once again maintained its leading position in terms of the number of mobile connections during the second quarter. There was an increase of 518,000 connections in the second quarter, including 197,000 in the postpaid segment. The company's focus on existing customers kept the churn rate among postpaid customers low. In the second quarter the churn rate decreased to 1.5 percent, and for O2 it even fell by 0.4 percentage points from the previous quarter to 1.3 percent.

The customer access base – taking into account the prevailing market definition of the time window for counting inactive customers – increased to 53.12) million through the end of June. Mobile connections accounted for 48.43) million of that total. In the fixed-line business, Telefónica Deutschland was able to increase the number of VDSL customers by 88,000 since the end of March to 960,000.

Dynamic growth in data usage and revenues

Data usage by Telefónica Deutschland's customers again showed a strong increase in the second quarter. O2 postpaid customers with an LTE tariff and smartphone consumed an average of 2 gigabyte (GB) per month – 48 percent more than a year ago. Other brands including Blau, ALDI TALK and AY YILDIZ also registered higher demand for data among their customers. The use of LTE tariffs also continued to increase. The number of LTE customers was up 53 percent to 14.4 million. Non-SMS mobile data revenues from April to June amounted to EUR 630 million, which was 9.8 percent more than in the second quarter of 2016.

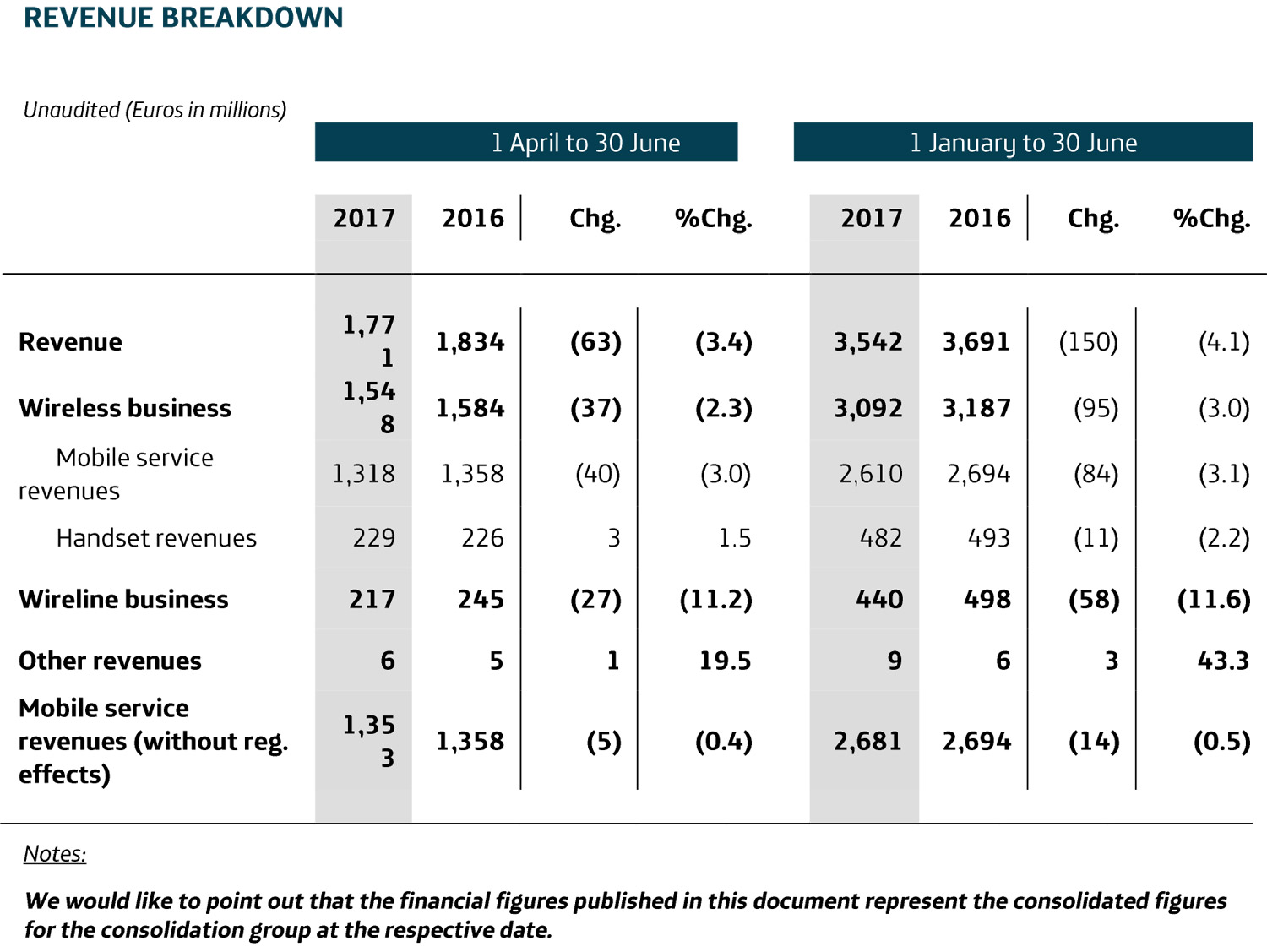

The first six months of the year were characterized by fierce competition and regulatory burdens. The revenue trend was negatively impacted in particular by the reduction in termination charges.

As a result, mobile service revenues (MSR) were decreased in the second quarter to EUR 1.32 billion (Q2 2016: EUR 1.36 billion). Adjusted for regulatory effects, this amounted to a decrease of 0.4 percent. This almost stable development represented an improvement from the preceding quarters. In the three months ended in March, MSR had decreased by 0.6 percent on the same basis.

Device sales in the second quarter, at EUR 229 million, were slightly higher than the previous year's figure of EUR 226 million. The quarter included the launch of the flagship smartphones Samsung Galaxy S8, HTC U11 and LG G6, among other products. Customers continue to wait longer before replacing their smartphones and tablets with newer models and purchase lower-priced models.

Fixed revenues decreased to EUR 217 million (previous year: EUR 245 million).

The consolidated revenues of Telefónica Deutschland in the second quarter of 2017 amounted to EUR 1.77 billion. This represents a year-on-year decrease of 3.4 percent.

Robust OIBDA excluding exceptional effects

The O2 Tower: Headquarter of Telefónica Deutschland in Munich

Again in the second quarter, Telefónica Deutschland was able to fully achieve its synergy targets. The company remains committed to its goal of capturing synergies representing EUR 900 million in operating cash flow by 2019. As planned, the company is on track to deliver 75 percent of this target by the end of the year.

The company achieved operating cost and revenue synergies of EUR 40 million over the past three months. At the same time, expenditures for marketing and service activities increased.

Thanks to the improved sales trend and the consistent implementation of the synergy plans, Telefónica Deutschland was able to increase its OIBDA excluding exceptional effects4) by 5 percent to EUR 472 million. In the preceding three months, the increase was 2.1 percent.

The OIBDA margin improved 2.1 percentage points in the second quarter to 26.7 percent. Investments (CapEx5)) rose by 6.9 percent from the year-earlier period to EUR 226 million due to the network consolidation and the rollout of LTE infrastructure.

The net result for the period from April to June was EUR -40 million (Q2 2016: EUR 252 million profit). As expected, the net result for the period under review was affected by further write-downs related to the integration of E-Plus and network consolidation. These had no effects on the company's liquidity and thus do not reflect its operational capabilities.

The free cash flow (FCF)6) in the second quarter amounted to EUR 69 million. Consolidated net financial debt7) stood at EUR 1.58 billion at the end of June. With a leverage ratio of 0.9, Telefónica Deutschland is still well within the target range of a maximum of 1.0.

On the path toward the OnLife Telco thanks to innovations

The company continued its transformation into the OnLife Telco in the second quarter. Its goal is to become the digital hub in customers' lives and to drastically reduce the complexity of everyday digital life.

An important focus in future-ready solutions is in the area of mobility. Consequently, the parent company Telefónica SA has joined the 5G Automotive Association (5GAA) in order to play a bigger part in efforts to develop standards in the field of autonomous driving. In a pilot project in Nuremberg, Telefónica NEXT, a subsidiary of Telefónica Deutschland, was involved in developing the first-ever method to use anonymised mobile telecommunications data to analyse traffic flows and, with that information, air quality. In May, the project earned Telefónica Deutschland a prize in the Sustainability Innovation category in the 2017 German Awards for Excellence.

Telefónica NEXT is joining a number of partners in a Berlin-based project aimed at optimizing local public transport through big data analyses. The start-up contributes insights from the analysis of anonymised mobile data to the project. Telefónica NEXT has also moved forward with the development of the Geeny IoT platform for consumer products. With the test phase complete, it is now available to developers and all interested companies.

Telefónica Deutschland continued with its social commitments in the second quarter with a diverse range of activities. As part of the third Think Big Tour, it helped students develop ideas how to promote an open and tolerant life within a multi-faceted society with the use of digital technology. It also presented the report “Digitally mobile in old age – how senior citizens use the Internet” together with the Stiftung Digitale Chancen. The study delivered new insights into the question how digitalisation can help the elderly participate in society.

Outlook

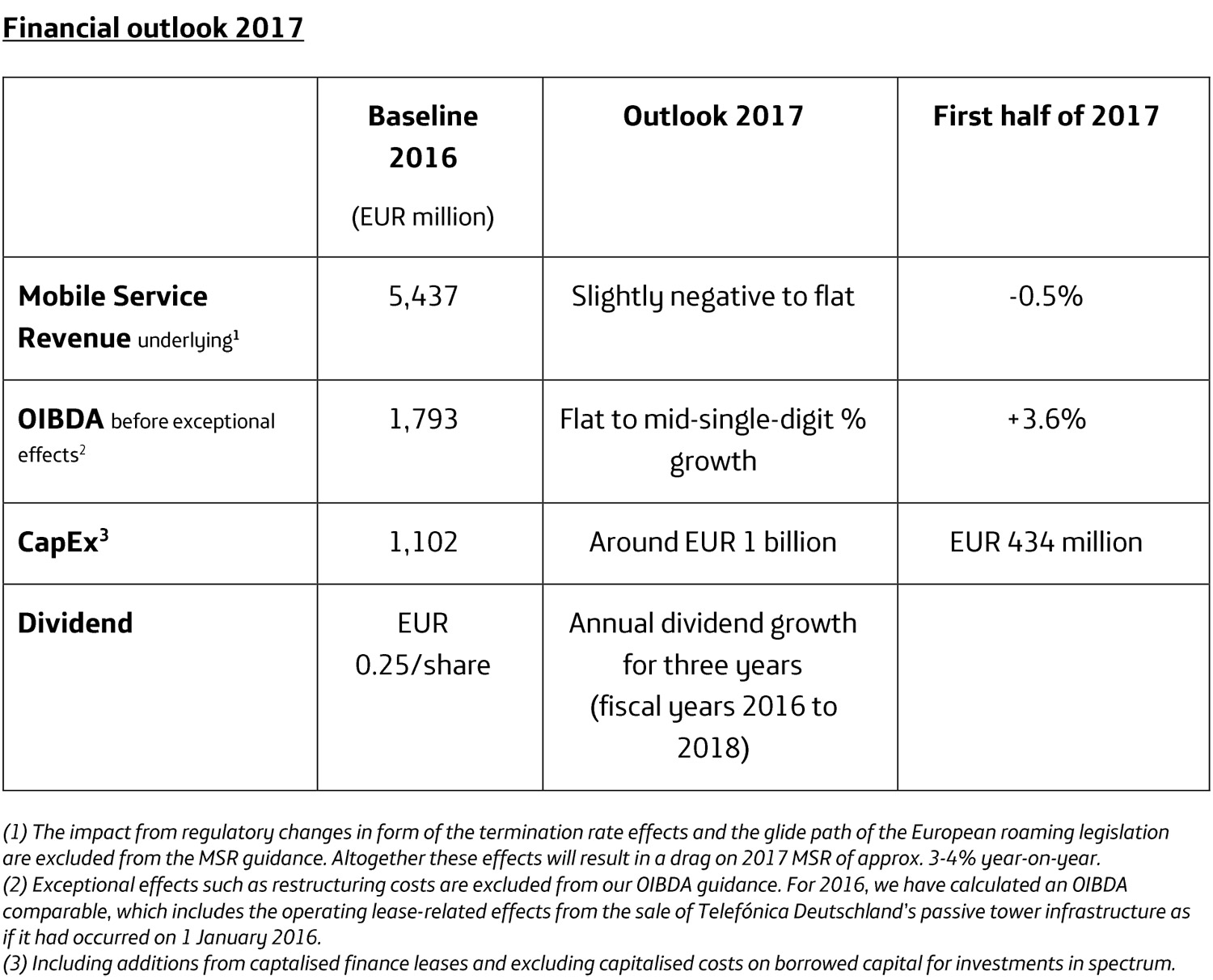

Telefónica Deutschland is reaffirming its outlook for the current 2017 fiscal year. The table below provides details of the financial outlook.

| (1) | The three months ending 30 June 2017 include restructuring expenses of EUR 19 million, while the same period of 2016 included restructuring expenses of EUR 14 million. For 2016, we have calculated an OIBDA comparable which includes the operating lease-related effects from the sale of Telefónica Deutschland’s passive tower infrastructure as if it had occurred on 1 January 2016. |

| (2) | According to the market-based calculation method. According to the conventional calculation method for mobile accesses, the number of connections is 49.9 million. |

| (3) | According to the market-based calculation method. According to the conventional calculation method for mobile accesses, the number of connections is 45.2 million. |

| (4) | The three months ending 30 June 2017 include restructuring expenses of EUR 19 million, while the same period of 2016 included restructuring expenses of EUR 14 million. For 2016, we have calculated an OIBDA comparable which includes the operating lease-related effects from the sale of Telefónica Deutschland’s passive tower infrastructure as if it had occurred on 1 January 2016. |

| (5) | Including additions from captalised finance leases and excluding capitalised costs on borrowed capital for investments in spectrum. |

| (6) | Free cash flow pre dividends and payments for spectrum (FCF) is defined as the sum of cash flows from operating activities and cash flows from investing activities. |

| (7) | Net financial debt includes current and non-current interest bearing financial assets and interest bearing liabilities as well as cash and cash equivalents and excludes payables for the spectrum auction. |