Dividend policy

The Company’s management board and the supervisory board intend to make suggestions for the distribution of dividends to the general shareholders’ meeting taking into account:

(i) the profit for the year;

(ii) historical and forecasted free cash flow;

(iii) distributable reserves available;

(iv) the current and expected leverage and financial condition of the Company;

(v) the general economic and business conditions;

(vi) any applicable legal and regulatory requirements; and

(vii) any other factors management may deem relevant.

Financing policy

The management board and supervisory board intend to maintain the Company’s investment grade rating (BBB from Fitch or equivalent from Moody’s and S&P) as well as the leverage ratio (calculated by dividing net financial debt according to IFRS16 by OIBDA according to IFRS16) at or below 2.5x over the medium term (the “Target Leverage”). Net financial debt will be measured as interest-bearing financial liabilities less interest-bearing financial assets, cash and cash equivalents, taking into account the value of financial derivatives and hedge arrangements. Future payment obligations in relation to the acquired 5G spectrum are not considered as financial debt. In order to assess compliance with the Target Leverage, OIBDA will be measured as operating income before depreciation and amortization for the last twelve months, excluding non-recurring and exceptional items.

According to its financing policy, the Company aims to:

(i) refrain from paying dividends, distributing capital or capital reserves in cash or buying back shares if the ratio of net financial debt/OIBDA materially and consistently exceeds the Target Leverage; and

(ii) restrict the use of new debt to pay dividends, allowing it only if the ratio of net financial debt/OIBDA complies with the Target Leverage.

The dividend for the financial year 2023 was paid in full from the tax contribution account within the meaning of section 27 of the German Corporation Tax Act (KStG) (contributions not made to the nominal capital). The payment is made without deduction of capital gains tax and solidarity surcharge. In the case of domestic shareholders, the dividend is generally not subject to taxation. The dividend is not subject to any tax refund or tax credit. Out of today's perspective, the dividend payment (subject to change) will continue to be made from the tax contribution account in the coming years. In the opinion of the German tax authorities, the dividend payment reduces the acquisition cost of the shares for tax purposes.

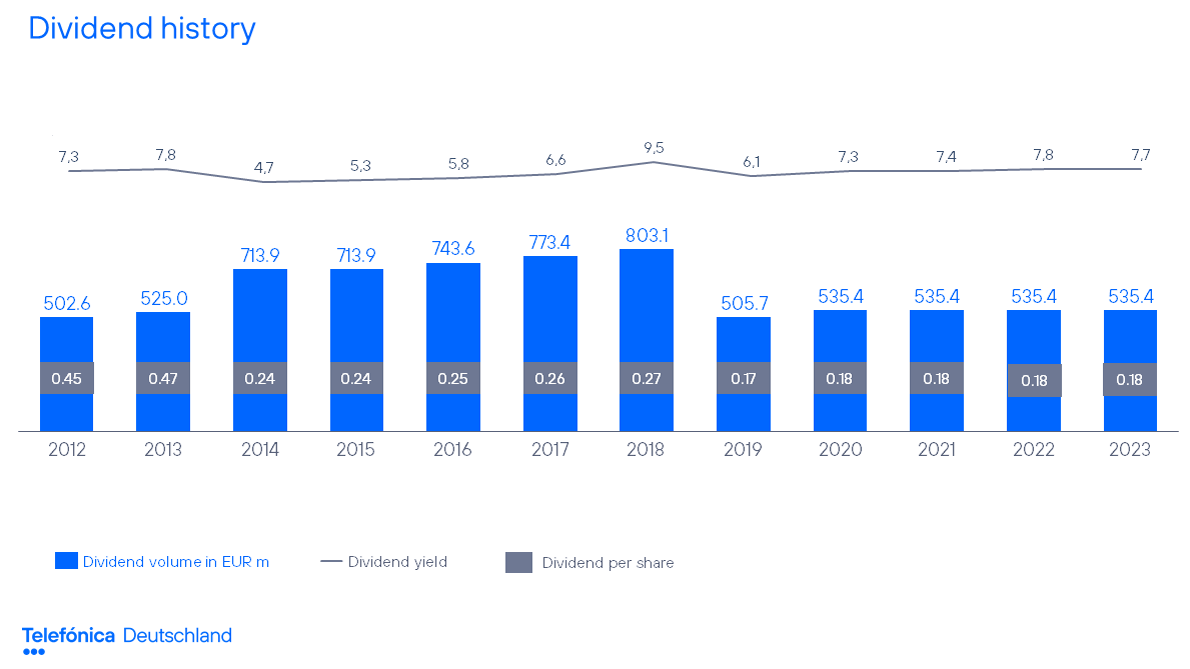

| Year | Distribution in total | Dividend per share1) | Date |

|---|---|---|---|

| 2023 | EUR 535,419,898.74 | EUR 0.18 | 18 June 2024 |

| 2022 | EUR 535,419,898.74 | EUR 0.18 | 17 May 2023 |

| 2021 | EUR 535,419,898.74 | EUR 0.18 | 19 May 2022 |

| 2020 | EUR 535,419,898.74 | EUR 0.18 | 20 May 2021 |

| 2019 | EUR 505,674,348.81 | EUR 0.17 | 20 May 2020 |

| 2018 | EUR 803,129,848.11 | EUR 0.27 | 21 May 2019 |

| 2017 | EUR 773,384,298.18 | EUR 0.26 | 17 May 2018 |

| 2016 | EUR 743,638,748.25 | EUR 0.25 | 9 May 2017 |

| 2015 | EUR 713,893,193.32 | EUR 0.24 | 19 May 2016 |

| 2014 | EUR 713,893,193.32 | EUR 0.24 | 12 May 2015 |

| 2013 | EUR 524,964,338.00 | EUR 0.47 | 20 May 2014 |

| 2012 | EUR 502,625,430.00 | EUR 0.45 | 7 May 2013 |

| 1) | for each share entitled to dividends |

Information for paying agent

BNP Paribas Securities Services S.C.A.

Europa-Allee 12

60327 Frankfurt am Main

Contact

For any questions related with the Telefónica Deutschland share please contact our Investor Relations-Team.